Q&A: What Do Public Companies Need to Know About the Universal Proxy Rules

11 minute read | December.15.2022

On November 17, 2021, the Securities and Exchange Commission (SEC) adopted rule and form amendments to the proxy rules, requiring the use of a “universal proxy card” in director election contests, and imposed new voting options applicable to all director elections. These amended rules apply to all shareholder meetings held after August 31, 2022. In addition to the rules, the SEC has since (most recently on December 6, 2022) published several Compliance and Disclosure Interpretations (C&DIs) and a “Small Entity Compliance Guide.”

The release and C&DIs have generated some confusion regarding implementation and impact of the rules and whether changes to company bylaws or other governing documents may be required. We have prepared the below Q&A to help you gain a better understanding of the universal proxy rules (Rule 14a-19 under the Securities Exchange Act of 1934), the subsequently released C&DI guidance, and to address the most common questions relevant to public companies as they prepare for the upcoming 2023 proxy season:

What is a universal proxy card?

Universal proxy cards list all duly nominated director nominees in a contested election. A contested election occurs when a company is soliciting proxies in support of its nominees and others are soliciting proxies in support of director nominees other than the company’s nominees. The new rules do not apply to non-contested director elections.

What do the universal proxy rules do?

The rules require management and dissident shareholders in director election contests to use a universal proxy card (see “What do universal proxy cards look like?”). To facilitate the use of universal proxy cards, the SEC amended the current proxy rules so each side can list the other side’s director candidates on its respective universal proxy card. The new rules also establish new notice and filing requirements for all soliciting parties as well as formatting and presentation requirements for universal proxy cards.

What is a “director election contest” or “contested election”?

These terms refer to an election of directors where a company is soliciting proxies in support of its own nominees and a separate person or group (referred to herein as a “dissident shareholder”) is soliciting proxies in support of director nominees different from the registrant’s nominees.

When are the universal proxy rules in effect?

Already. The rules regarding universal proxy apply to all shareholder meetings involving contested director elections held after August 31, 2022.

How would a dissident shareholder comply with the universal proxy rules?

There are certain procedural requirements with which dissidents must comply and ensure inclusion of their nominees on a universal proxy card:

- They must first provide timely written notice of their nominees to the company.[1] See “When must a dissident shareholder submit its notice to inform a company of its intent to present its own director nominees?”

- The notice must include the names of all nominees for whom they intend to solicit proxies.[2]

- The notice must include a statement that they intend to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote in the company’s election of directors.[3]

- If the intention to solicit at least 67% or the names of the dissident nominees change, they must notify the company promptly.[4]

- They must file their definitive proxy statement at least 25 calendar days before the date of the meeting or within 5 calendar days after the company files its definitive proxy statement, whichever is later.[5]

- They must actually solicit holders of shares representing at least 67% of the voting power of the shares entitled to vote in the company’s election of directors.[6]

Must a dissident shareholder comply with any minimum share ownership threshold requirements before using the universal proxy rules?

No. Any level of share ownership will be sufficient for universal proxy rule purposes.

Can a dissident shareholder avoid providing its own universal proxy card and, instead, rely exclusively on a company’s universal proxy card to seek to have its director nominees elected?

No. As the SEC clarified in C&DI Question 139.06,[7] dissident shareholders must also provide a universal proxy card that includes the names of all director candidates, including those nominated by the company or any other soliciting parties. Dissident shareholders must also solicit holders of at least 67% of the voting power of shares entitled to vote on the director election contest. These requirements are intended to prevent dissident shareholders from capitalizing on the inclusion of their nominees on a company’s universal proxy card without undertaking meaningful solicitation efforts of their own.

How must a company respond to a dissident shareholder that complies with the universal proxy rules?

The company must provide a list of its nominees to the dissident for inclusion in their universal proxy card. Such list must be delivered no later than 50 calendar days prior to the anniversary of the previous year’s annual meeting date.[8] If the names of the company’s nominees change, they must notify the dissident promptly.

Must a company include information about a dissident’s nominee(s) in its proxy statement?

No. However, under new Item 7(f) of Schedule 14A, companies and dissidents are required to include in their proxy statements a statement directing shareholders to refer to any other soliciting person’s proxy statement for the information required by Item 7 of Schedule 14A about such person’s nominee(s). The statement must explain to shareholders that they can access the other soliciting person’s proxy statement, and any other relevant documents, without cost on the SEC’s website.

When must a dissident shareholder submit a notice to inform a company of its intent to present its own director nominee(s)?

The minimum default under the rule is “no later than 60 calendar days prior to the anniversary of the previous year’s annual meeting date.”[9]

However, this 60 calendar-day period is a minimum that does not override or supersede a longer period established in a company’s governing documents.[10] Accordingly, the notice period can be longer for companies with advance notice provisions in their bylaws that impose an earlier deadline for providing notice of a dissident’s nominee(s). Such advance notice provisions typically require notice from 90 to 120 days before the anniversary of the previous year’s annual meeting date.

Accordingly, where a company’s advance notice bylaw requires notice of nominees earlier than the 60 calendar-day minimum, such earlier notice period can apply. See “When can a company’s earlier advance notice bylaw period apply?”

When can a company’s earlier advance notice bylaw period apply?

Rule 14a-5(e)(4) requires companies to disclose in their proxy statements the deadline for a dissident shareholder to provide notice of its director nominees for election at the next annual meeting. As indicated above, the default minimum is 60 calendar days prior to the anniversary of the previous year’s annual meeting date. If a company’s advance notice bylaw provision imposes an earlier deadline for notice of a dissident shareholder’s nominee(s) than that minimum, the company can disclose the earlier advance notice bylaw deadline to satisfy the requirement of Rule 14a-5(e)(4).

However, the universal proxy rules also require specific information to be included in the notice (see “How would a dissident shareholder comply with the universal proxy rules?”), such as a statement that the dissident shareholder intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors. To the extent a company’s advance notice bylaw provision does not require this additional information be contained in the notice, then the company could either:

- amend the bylaws to reflect the universal proxy rule requirements (see “Should a company amend its bylaws to address the universal proxy rules?”); or

- ensure its proxy statement clearly states “the need for a dissident shareholder to comply with the additional requirements of Rule 14a-19(b).”[11] A sample statement is shown below, which could be included in the section of the proxy statement providing the deadlines required by Rule 14a-5(e):

- “In addition, shareholders who intend to solicit proxies in support of director nominees other than the company’s nominees must comply with the additional requirements of Rule 14a-19(b).”

If a company does not take either or both of the above actions, the default minimum 60 calendar-day period would apply.

If a dissident shareholder submits nominees but fails to satisfy a company’s advance notice bylaw requirements, must those nominees be included in the company’s proxy card?

No. As the SEC clarified in C&DI Question 139.04,[12] only duly nominated candidates are required to be included on a universal proxy card. Therefore, if a company determines received nominations are invalid due to failure to comply with advance notice bylaw requirements, the company will not need to include the names of the dissident shareholder’s nominees on its proxy card pursuant to universal proxy Rule 14a-19(e)(1).

What should a company do if a dissident shareholder sues because their nominees were excluded after the company determined the dissident shareholder’s director nominations did not comply with the advance notice bylaw requirements?

As the SEC clarified in C&DI Question 139.05,[13] the company would need to disclose in its proxy statement:

- its determination that the dissident shareholder’s director nominations are invalid;

- a brief description of the basis for that determination;

- the fact that the dissident shareholder initiated litigation challenging the determination; and

- the potential implications (including any risks to the company or its shareholders) if the dissident shareholder’s nominations are ultimately deemed to be valid.

If a company furnishes proxy cards that do not include the dissident shareholder’s director candidates and a court later finds the dissident shareholder’s candidates were duly nominated, then the company would be required to furnish universal proxy cards with the dissident shareholder’s nominees and would need to discard any previously furnished proxy cards received. The company may also be forced to postpone or adjourn the meeting if there is not sufficient time for shareholders to cast their votes on the universal proxy cards prior to the shareholder meeting.

If a dissident shareholder does not sue after their nominees were excluded, the above disclosure obligations would not apply.

Should a company amend its bylaws to address the universal proxy rules?

Although not required, companies should consider amending their bylaws to align with the universal proxy rules, including:

- requiring dissidents to represent their intent to comply with Rule 14a-19, including “a statement that such person intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors in support of director nominees other than the registrant’s nominees;”[14]

- requiring dissidents that have provided notice under Rule 14a-19 to also provide reasonable evidence they have complied with Rule 14a-19 shortly prior to the meeting;

- specifying the consequences of a dissident’s failure to comply with Rule 14a-19 (namely, disregarding their nominees);

- requiring dissidents to use a proxy card color other than white, to reserve that color for the company’s card.

Even if a company amends its bylaws to align with the universal proxy rules, it would still be prudent to ensure its proxy statement clearly states “the need for a dissident shareholder to comply with the additional requirements of Rule 14a-19(b),” as described above under “When can a company’s earlier advance notice bylaw period apply?”

If universal proxy cards are required, what must they contain?

The company and the dissident shareholders must each ensure their universal proxy cards:

- list all nominees from all parties, grouped according to their nominating party, listed alphabetically by last name within each group, and shown in a uniform style of presentation (using the same font type, style, and size for all nominees);[15]

- state the maximum number of nominees for which the shareholder may vote;[16]

- include an explanation of how cards showing too few votes, cards showing too many votes, and cards that are signed but unmarked will be treated;[17] and

- optionally, and according to certain limitations, the card may provide a means by which shareholders may vote for (or withhold authority to vote for) an entire group of nominees.[18]

Rule 14a-19(e) requires each soliciting party in a director election contest to use a universal proxy card. The rules do not allow a dissident shareholder to rely exclusively on the company’s proxy card to have its director nominees elected.[19]

What do universal proxy cards look like?

See proxy statements and universal proxy card filings for a contested election linked below (the universal proxy cards are located at the end of each linked filing):

- Company filing: Apartment Investment and Management Company.

- Dissident group filing: Land & Buildings Capital Growth Fund, LP.

Are any companies exempt from the universal proxy rules?

Registered investment companies and business development companies are not subject to the universal proxy rules.

Were any other changes made in connection with the universal proxy rules?

Yes. The SEC also adopted rule amendments regarding the presentation of voting options on any proxy card applicable to director elections. Under amended Rule 14a-4(b)(4):[20]

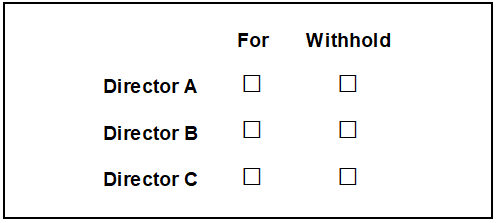

- Where voting standards do not give legal effect to votes cast against a nominee (such as a plurality voting standard), the proxy card may not include an “against” option and, instead, must provide a “withhold authority to vote” option opposite the name of each nominee.[21]

Example:

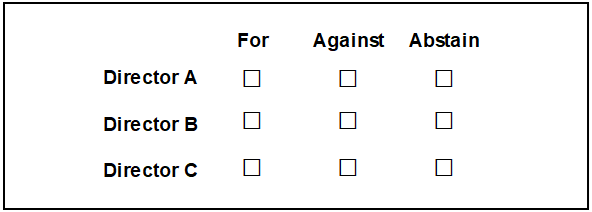

- Where voting standards do give legal effect to votes cast against a nominee (such as a majority voting standard), the proxy card must include an “against” and “abstain” voting option instead of a “withhold authority to vote” option.

Example:

Where can the universal proxy rule adopting release, corresponding C&DIs, and “Small Entity Compliance Guide” be found?

The final rule is available here.

The SEC Fact Sheet is available here.

The C&DIs are available here.[22]

The “Small Entity Compliance Guide” is available here.

*****

Please contact one of the listed authors of this article, or your regular Orrick contact, if you have any questions regarding the universal proxy rules.

[8] Except that, if the company did not hold an annual meeting during the previous year, or if the date of the meeting has changed by more than 30 calendar days from the previous year, such list must be provided no later than 50 calendar days prior to the date of the annual meeting. Rule 14a-19(d).

[9] Except that, if the company did not hold an annual meeting during the previous year, or if the date of the meeting has changed by more than 30 calendar days from the previous year, then notice must be provided by the later of 60 calendar days prior to the date of the annual meeting or the 10th calendar day following the day on which public announcement of the date of the annual meeting is first made by the company. Rule 14a-19(b)(1).

[21] Under amended Rule 14a-4(b)(4), in lieu of a “withhold” checkbox for each nominee as shown above, other permissible means for security holders to withhold authority to vote include:

- An instruction in bold-face type which indicates that the security holder may withhold authority to vote for any nominee by lining through or otherwise striking out the name of any nominee;

- Designated blank spaces in which the security holder may enter the names of nominees with respect to whom the security holder chooses to withhold authority to vote; and

- Any other similar means, provided that clear instructions are furnished indicating how the security holder may withhold authority to vote for any nominee.

[22] Refer to “Section 139. Rule 14a-19” – Questions 139.01 through 139.06.