Africa

Africa is poised for tremendous growth over the next half-century. With a population set to double to 2.4 billion by 2050, the continent has infrastructure and commercial sectors that are undergoing rapid development. Our Africa practice is helping our clients – in Africa and worldwide – to lead this transformation.

Chambers Global ranks Orrick as a leading firm for Projects & Energy, Corporate/Commercial and Dispute Resolution. We are advising on some of the most significant and innovative projects underway on the continent today. Our clients include all types of market participants – development banks, commercial lenders, sponsor groups, multinational corporations, governments, funds and other private investors. Our work spans the continent’s energy, infrastructure, natural resources, large-scale agriculture complexes, telecommunications, technology and financial sectors.

Our team is based in Paris, London, New York, Washington, D.C. and Beijing. We have built a first-class network of local law firms in African countries where our clients do business. We collaborate closely with these firms on transactions, and also benefit from regular dialogue on the latest local market trends and legislative and regulatory changes. In addition, in certain major jurisdictions such as Togo, Kenya, South Africa and Nigeria, we have entered into special collaboration arrangements with top-tier firms and leading practitioners to support clients’ recurrent projects.

Projects and Project Finance

We are advising on some of the most significant and innovative projects underway across the continent today. Chambers Europe 2017 notes that clients praise our team: "They know the African market very well."

-

We are involved in a wide range of projects in the energy sector. These projects involve investors based throughout Europe, the Middle East, Africa, the Americas and Asia. Recent highlights include:

- Acting on all energy matters for Cameroonian energy flagship ENEO, owned by Actis and the Republic of Cameroon, including the development of a €1.2 billion 420 MW hydropower plant in southern Cameroon - the largest ever funded independent power producer to date in Africa and first to be finalized after the extension of the electricity sector reform

- Advised on the first FLNG facility in the African market and one of the first worldwide on behalf of Golar LNG

- Advised Exxaro Resources, one of South Africa’s largest diversified mining companies, on its combination of mining, mineral separation and smelting mineral sands operations with proprietary pigment-making technology

- Advised Eranove in connection with the development and financing of a 60MW gas fired power plant in Togo

- Acting for commodity-trading firm Engelhart in executing structured commodity transactions across Africa, including in Ghana, Kenya and Tanzania

- Advising CDC Group PLC, through its subsidiary Zambian Transmission LLP, in connection with an offer for all of the ordinary shares in the Zambian company, Copperbelt Energy Corporation Plc (“CEC”), which is listed on the Lusaka Stock Exchange

In addition, we advise some of the most active private equity funds focused on African energy and infrastructure, including Helios Investment Partners, Leap Frog Investments and Adlevo Capital.

Telecommunications and Technology

We act for all major stakeholders in the development of the telecommunications and tech sectors. We recently advised the Overseas Private Investment Corporation in connection with a loan to a telecommunications conglomerate of 17 affiliated borrowers providing cable, satellite and internet services in Kenya, Tanzania, Uganda, Mauritius and United Arab Emirates (Fujairah Free Zone). Other clients in the Africa telecoms space include Millicom, Eutelstat and CANAL+.

We’re also deeply involved in the development of Africa’s ecommerce market, and have advised venture capital firms, private equity investors and companies making strategic acquisitions and investments in areas from mobile money markets to online video platforms.

Capital Markets and Finance

Our teams play a pioneering role in assisting market participants and regional market authorities that shape local and regional financial and capital markets. In West Africa, for example, we worked with the regional financial market authority CREPMF, which covers 8 WAEMU countries, and the West African Development Bank on the preparation and enactment of common regulations to WAEMU countries relating to securitization, covered bonds and the establishment of a regional mortgage refinancing agency.Our recent work includes:

- Representing major international commercial banks in the context of the partial guarantee approved by the African Development Bank to cover the payment obligations of the Republic of Cameroon related to the cross currency swaps executed with the banks to hedge the proceeds of a $750 million Eurobond

- Assisting various international financial institutions and multinational corporations with derivatives agreements

- Advising arrangers and originators on the securitization of various classes of assets (e.g., sovereign debts, commercial receivables)

- Representing investors and various market participants with respect to commercial real estate financings and refinancings, including through securitization structures

Dispute Resolution

Chambers Global 2017 praises our International Arbitration team’s "distinguished presence across francophone jurisdictions of Africa, with noteworthy expertise in the telecommunications, construction and mining sectors." Our team represents parties in some of the largest arbitrations underway, governed by the rules of ICSID, ICC and UNCITRAL, among others, and conducted in English and French.

In dispute resolution work, we have:

- Represented a Tunisian company in a dispute with a European consortium relating to the modernization of a railway – under ICC Arbitration Rules and governed by French law

- Acted for an American company in dispute with an Algerian state-owned company relating to the construction of a gas-liquefication plant – under ICC Arbitration Rules and governed by Algerian law

- Assisted a Tunisian company in a dispute against an Italian company relating to the construction of a flour mill – under the ICC Arbitration Rules, in French

- Acted for a French company in a litigation relating to the installation of turbines in an energy-production plant in Algeria – under the ICC Arbitration Rules, seated in Geneva

- Represented an oil company that was in a dispute with an African state relating to the remediation of offshore oil sites – under the UNCITRAL Arbitration Rules, seated in Rome

We bring to dispute resolution, as to all of our work in Africa, a strong combination of technical skills, market knowledge, and local and international relationships.

Our Commitment to the Community

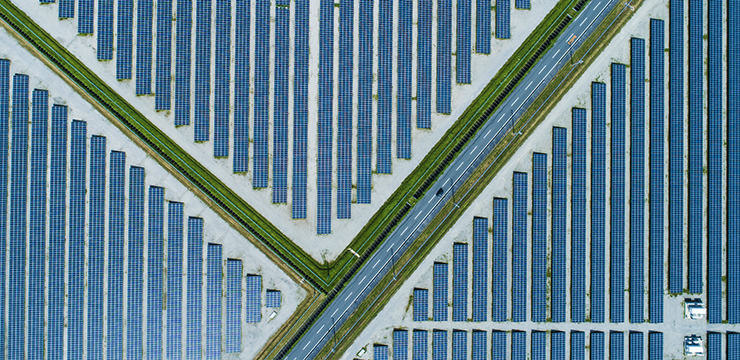

We are honored to partner with social enterprises devoted to empowering Africa. We are representing The Nature Conservancy in connection with an innovative project to develop a series of solar power plants in Kenya, the proceeds of which will finance nature conservancies and game reserves. We helped secure impact financing for Greenlight Planet – a social enterprise that develops and manufactures solar products designed to help people living off the electric grid – and likewise assisted MercyCorps in its impact investment into New Light Africa Limited, a company that sells solar lights. And we are corporate counsel to NewGlobe Schools, a corporation that brings education to families living on less than $2 a day, including in emerging markets such as Kenya, through smartphones and tablets. We also work closely with Indego Africa, an organization devoted to women’s entrepreneurship and with Water.org.

Insights

Hugues Martin-Sisteron on Senegal's Landmark Renewable Energy Project

2 minute read | October.20.2025