- Assist clients with all aspects of the mortgage origination process, such as:

- Developing loan products

- Advertising and marketing, lead generation, joint ventures, digital shopping platforms, co-branding, product bundling and applying anti-kickback requirements to business development

- Taking and processing applications

- Providing preapprovals or prequalifications

- Underwriting, including qualified mortgage/ability-to-repay (QM/ATR) determinations, direct endorsement (DE) underwriting for FHA mortgagees, and appraisal ordering and review processes

- Providing required federal, state and investor/insurer-specific disclosures

- Developing loan originator compensation (LO comp) policies and plans

- Ensuring satisfaction of fair lending obligations

- Vetting, approving and maintaining vendor relationships

- Facilitating electronic disclosure delivery and provision of signatures

- Obtaining and maintaining approvals from state licensing authorities, insurers and investors, and complying with state- and program-specific requirements, including considerations related to assertion of federal preemption

- Outsourcing arrangements

- Provide representation in regulatory examinations, audits, investigations and enforcement actions, and private litigation pertaining to, for example:

- Alleged non-compliance with disclosure, fee limitation, QM/ATR, LO comp, RESPA anti-kickback, fair lending, and other legal and regulatory requirements

- Alleged unfair, deceptive, or abusive acts or practices (UDAAP or UDAP)

- False Claims Act (FCA), Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), and Program Fraud Civil Remedies Act (PFCRA) claims

- Negotiate loan purchase and sale agreements and various types of outsource, vendor and marketing agreements

- Assist with remedial efforts to enhance origination policies, procedures, practices and internal controls, including through the preparation of comprehensive legal requirement inventories, risk assessments, policies, procedures and job aids

Mortgages

Orrick is a leading provider of legal services to the mortgage industry, using an integrated team approach to help mortgage originators, servicers, investors and other industry participants solve critical regulatory, compliance, licensing, agency approval, enforcement, litigation and transactional challenges.

Trusted Advisers to the Mortgage Industry

We deliver innovative solutions to mortgage industry participants of all sizes, from the nation’s largest financial institutions to start-up firms and third-party vendors. Our clients include mortgage lenders, brokers, insurers, servicers, home builders, document preparation firms, national and regional real estate brokerages, credit and tax services firms, lead generators, and mortgage industry trade associations, among others.

We are recognized authorities on the laws affecting mortgage origination, servicing and investing, such as:

- Real Estate Settlement Procedures Act (RESPA)

- Truth-in-Lending Act (TILA)

- Equal Credit Opportunity Act (ECOA)

- Fair Housing Act (FHA)

- Home Ownership and Equity Protection Act (HOEPA)

- Home Mortgage Disclosure Act (HMDA)

- Homeowners Protection Act (HPA)

- Fair Credit Reporting Act (FCRA)

- Flood Disaster Protection Act (FDPA)

- Mortgage Acts and Practices (MAP) Rule

- National Housing Act (NHA)

- Servicemembers Civil Relief Act (SCRA)

- Unfair, Deceptive or Abusive Acts or Practices (UDAAP or UDAP)

- Telemarketing acts and rules

- The myriad of state laws governing mortgages

- Federal laws providing preemption of state laws

-

- Advise clients—including specialty servicers, subservicers and mortgage servicing rights (MSR) holders—on all aspects of servicing and default servicing, such as:

- Periodic statements and notices

- Payment application

- Managing escrows

- Hazard (including flood) insurance monitoring and lender placed insurance

- Portfolio retention

- Collection activities

- Vendor management

- Use of affiliate providers for default or other services

- Loss mitigation, including forbearances, deferrals, partial claims and loan modifications

- Short sales/pre-foreclosure sales (PFS) and deeds-in-lieu of foreclosure (DIL)

- Foreclosures

- Filing claims with insurers and investors

- Obtaining and maintaining approvals from state licensing authorities, insurers and investors, and complying with state- and program-specific requirements, including considerations related to the assertion of federal preemption

- Provide representation in regulatory examinations, audits, investigations, and enforcement actions, and private litigation pertaining to, among other things:

- Lender-placed insurance

- Fair and responsible servicing

- Loss mitigation, foreclosure alternatives and foreclosure prevention

- Foreclosure

- Borrower bankruptcy

- Vendor management matters

- Alleged unfair, deceptive, or abusive acts or practices (UDAAP or UDAP)

- False Claims Act (FCA), Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), and Program Fraud Civil Remedies Act (PFCRA)-related issues

- Negotiate mortgage servicing rights purchase and sale agreements, sub-servicing agreements, and various types of vendor agreements

- Assist with remedial efforts to enhance servicing policies, procedures, practices, and internal controls, including through the preparation of comprehensive legal requirement inventories, risk assessments, policies, and procedures

Our Solutions

We offer decades of experience as trusted counselors across regulation, enforcement, litigation, transactions and licensing, and our team approach informs our advice across the entire spectrum of work that we do.

In addition to providing experienced regulatory compliance and counseling services, we guide mortgage industry clients through regulator, investor and insurer examinations, audits, investigations and enforcement actions.

-

We provide regulatory counseling and risk management advice to ensure compliance with evolving federal and state laws and regulations, support new product development, and guide geographic expansion.

- Develop compliance management programs, including written policies, training, and ongoing monitoring to address compliance with evolving lending laws and regulations

- Advise clients regarding compliance with federal and state laws impacting the mortgage industry, as well as investor (e.g., Fannie Mae, Freddie Mac, Ginnie Mae) and insurer/guarantor (e.g., FHA, VA, USDA) requirements, with deliverables tailored to our clients’ needs (e.g., oral guidance, email responses, formal memoranda and opinions, comprehensive surveys)

- Conduct 50-state surveys of laws governing the mortgage industry and risk assessments for compliance with consumer financial protection laws and investor/insurer requirements

- Provide regtech solutions such as Winnow, a comprehensive, interactive, and searchable database of more than 80,000 state and federal requirements that allow subscribers to generate legal inventories tailored by business type, license, and product, as well as laws related to servicing, and topics like marketing and advertising, debt collection, telemarketing, notary requirements, electronic signatures and documents, powers of attorney, and privacy and data security

- Cover all mortgage types, including residential and non-residential; consumer and business-purpose; purchase, refinance, construction and bridge; first and subordinate lien; down-payment assistance; home equity loans and lines of credit (HELOC); forward and reverse mortgages/home equity conversion mortgages (HECM); and QM and non-QM

-

Our integrated approach to licensing gives clients an advantage through every phase of the multistate licensing and federal approval process, from identifying potential target licenses, to drafting initial applications, responding to follow-on requests and interacting with regulatory agencies post-approval.

- Work with lead generators, mortgage brokers, lenders, mortgage loan originators (MLOs), servicers, sellers, purchasers, investors and mortgage servicing rights (MSR)-owners—as well as debt collectors and other non-depository financial institutions—to obtain licenses in all 50 states, the District of Columbia and most U.S. territories

- Navigate clients through amendments to corporate structure and change of control, management and location, Certificate of Authority, and DBA filings, including assistance with filings within and outside the Nationwide Mortgage Licensing System (NMLS)

- Help clients obtain and maintain authority to lend, service, invest, or sell mortgage loans, or issue mortgage backed securities (MBS), through loan programs such as:

- Department of Housing and Urban Development (HUD) / Federal Housing Administration (FHA)

- Department of Veterans Affairs (VA)

- Department of Agriculture (USDA), Rural Housing Service (RHS)

- Government National Mortgage Association (Ginnie Mae / GNMA)

- Federal National Mortgage Association (Fannie Mae / FNMA)

- Federal Home Loan Mortgage Corporation (Freddie Mac / FHLMC)

-

Our firm represents clients in the mortgage industry through every stage of government examinations or audits, investigations and enforcement actions, with a team that includes former government attorneys who bring valuable insights into the agencies’ approaches.

- Prepare responses to audit reports, review and revise compliance documents, conduct risk assessments, oversee loan file reviews and conduct effective internal investigations (including with respect to whistleblower allegations)

- Counsel clients through complex parallel proceedings, which can involve enforcement by multiple federal and state agencies across multiple states, civil litigation, congressional investigations and class actions

- Represent clients in state matters such as mortgage lender and banking regulator inquiries, examinations and enforcement actions, including joint examinations, matters involving multiple state attorneys general and actions through the Multistate Mortgage Committee (MMC)

- Guide clients through examinations, inquiries, investigations, and enforcement actions initiated by federal agencies, including the Federal Trade Commission (FTC), Department of Justice (DOJ), the prudential banking regulators, and the Consumer Financial Protection Bureau (CFPB).

-

Our attorneys bring decades of experience to government loan program matters and help clients strategically navigate their relationships with the government loan insurers/guarantors and the Government National Mortgage Association (Ginnie Mae).

- Department of Housing and Urban Development (HUD)/Federal Housing Administration (FHA) matters include:

- Assisting with annual recertification processes, notices of material events, and other matters before the Lender Approval and Recertification Division

- Responding to FHA Quality Assurance Division (QAD) and Homeownership Center (HOC) reviews and audits

- Representing clients with:

- Mortgagee Review Board (MRB) Requests for Information (RFI) and Notices of Violation (NOV)/Notices of Intent to Seek Civil Money Penalties

- Office of Hearings and Appeals (OHA) proceedings

- Program Fraud Civil Remedies Act (PFCRA) actions

- HUD Office of Inspector General (OIG) audits and investigations

- HUD Office of General Counsel (OGC) inquiries

- We undertake similar representations relating to the Ginnie Mae mortgage backed securities (MBS) program, as well as the Department of Veterans Affairs (VA) and Department of Agriculture (USDA)/Rural Housing Service (RHS) loan programs

-

Our litigators defend mortgage-related class action and complex civil claims, ranging from multi-district class and mass actions and other complex civil litigation to arbitration and alternative dispute resolution (ADR) proceedings.

- Experience includes defending against allegations of fair and responsible lending violations, unfair competition and deceptive trade acts and practices, fraud, false statements, false claims, true lender, breach of contract, loan repurchase claims, and breach of fiduciary duties, as well as alleged violations of other regulations and laws governing the mortgage industry (e.g., TILA/Regulation Z, RESPA/Regulation X, ECOA/Regulation B, FCRA/Regulation V)

- Provide mortgage industry clients with a strong appellate practice and serve as amicus curiae counsel on cases that impact the industry

-

We help our clients negotiate favorable business terms by leveraging our knowledge of the mortgage industry and its business risks, our litigation and enforcement experience, and our deep understanding of the relevant laws and regulatory expectations.

- Conduct regulatory and corporate due diligence of both acquisition and investment targets, as well as service providers

- Provide transaction representation for mergers and acquisitions of mortgage lenders, servicers, brokers, settlement service providers and other service providers; asset purchase and sale transactions, including loans and servicing rights; and distressed asset purchases and sales agreements

- Negotiate and document correspondent, wholesale lending, broker, servicing and subservicing, pooling and servicing, warehouse lending and other credit facility, outsourcing, co-branding, portfolio retention, and marketing and affinity marketing agreements

- Advise on vendor transactions that include loan origination, servicing, collections, settlement services, vendor arrangements, the provision of technology services, and joint ventures and marketing arrangements under the Real Estate Settlement Procedures Act’s (RESPA) affiliated business arrangement rules

-

- Assisted a wide range of bank and nonbank lenders and servicers in adapting systems and procedures to implement the sweeping mortgage regulations adopted under the Dodd-Frank Act, including the Ability-to- Repay/Qualified Mortgage Rule, Loan Originator Compensation Rule, Mortgage Servicing Rules, Truth in Lending Act-Real Estate Settlement Procedures Act (TILA-RESPA) Integrated Disclosure Rule (TRID), and Home Mortgage Disclosure Act (HMDA)

- Represented numerous mortgage servicers in CFPB investigations regarding alleged violations of RESPA, the Mortgage Servicing Rules (MSR) and the prohibition on unfair, deceptive, or abusive acts or practices (UDAAP)

- Conducted due diligence and transactional work in connection with numerous mortgage lender and servicer acquisitions

- Conducted substantial reviews of disclosure and loan documents for mortgage lenders transitioning to new document vendors

- Represented mortgage servicer in a complex investigation involving the interplay of the Bankruptcy Code and RESPA’s escrow rule

- Represented a U.S. financial services company in its exit from the mortgage business

- Represented a private equity firm in an equity investment in a reverse mortgage lender

- Represented a mortgage company in $100M stock sale to a private-equity firm

- Represented a Wall Street bank in a mortgage loan private-label outsourcing arrangement, including related servicing and loan sale agreements

- Represented a client in the acquisition of two mortgage-related fintech companies

- Represented clients in connection with various portfolio retention structures

- Represented clients in establishing Affiliated Business Arrangements/joint ventures

- Represented FHA Non-Supervised Mortgagee in HUD OIG audit of the Mortgagee’s compliance with COVID-19 loss mitigation assistance requirements

- Represented numerous FHA Mortgagees in a wide variety of matters before HUD’s Mortgagee Review Board and Office of Hearings and Appeals

- Updated and augmented lenders’ and servicers’ policies for complying with the Flood Disaster Protection Act

- Counseled clients from the beginning to end of their CFPB mortgage origination, servicing and HMDA examinations

- Assisted numerous Issuers with their responses to Ginnie Mae Notices of Intent to Seek Civil Money Penalty

Internet-Veröffentlichungen

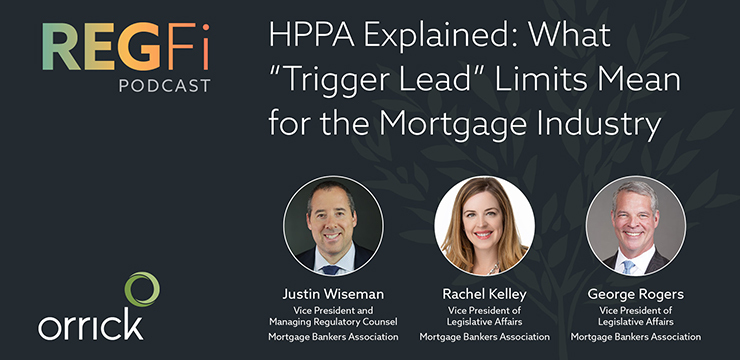

RegFi Episode 73: HPPA Explained: What “Trigger Lead” Limits Mean for the Mortgage Industry

34 minute listen | September.25.2025

RegFi Episode 71: GENIUS Act: Establishing a Federal Regulatory Framework for Stablecoins

31 minute listen | September.03.2025

Veranstaltungen

MBA Compliance & Risk Management Conference

September.28.2025 - September.30.2025

MBA Legal Issues and Regulatory Compliance Conference

May.14.2025 - May.17.2025