How Major Corporations Are Changing Their Sustainability Reporting Practices

9 minute read | September.02.2025

Originally published in Law360; reprinted with permission.

The sustainability reporting landscape is undergoing a transformation. Many companies are considering how to balance voluntary sustainability reporting with a wave of new regulatory requirements, all within an environment of economic uncertainty and ongoing changes to key reporting standards and frameworks.

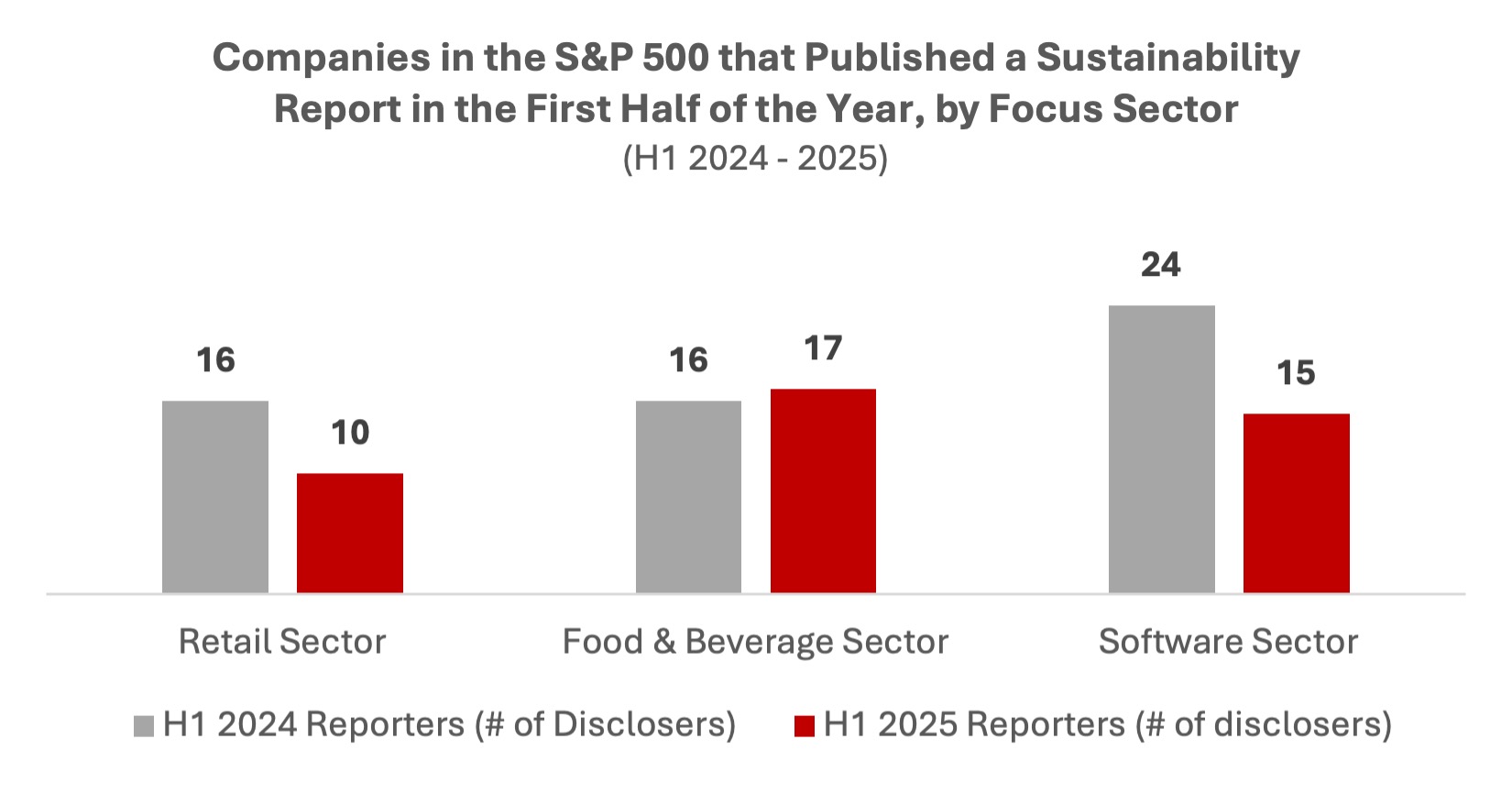

This changing landscape is having a major impact on reporting practices: We found a 26% drop in the number of S&P 500 companies that published a sustainability report in the first half of 2025, compared to the same period in 2024.[1] If sustained through the rest of 2025, this significant drop will be a reversal of a long-term trend that saw more than 98% of the S&P 500 publish a sustainability report in 2024.

In this article, we provide sectoral and temporal comparisons to describe the evolving landscape of sustainability reporting in the S&P 500, focused on three sectors: retail,[2] food and beverage,[3] and software.[4]

Declining Disclosure

April, May and June are usually the busy season for sustainability professionals. Historically, nearly half of the S&P 500 have published their sustainability reports in these three months, and nearly two-thirds of the index have typically published their report in the first half of the year.

However, we found a significant decline in the number of S&P 500 companies that published their sustainability report in this period. Compared to the first half of 2024, 26% fewer companies released reports in the first half of 2025.

The fall in sustainability reporting across the S&P 500 suggests that, while sustainability issues may remain important to certain businesses, companies are reassessing the costs and benefits of public disclosure, with sector-specific dynamics influencing reporting decisions.

This downward trend is more pronounced in certain sectors. While the retail and software sectors each experienced a 38% drop in reporting from the first half of 2024 to the first half of 2025, the number of companies in the food and beverage sector publishing a sustainability report increased.

Shifting Timelines

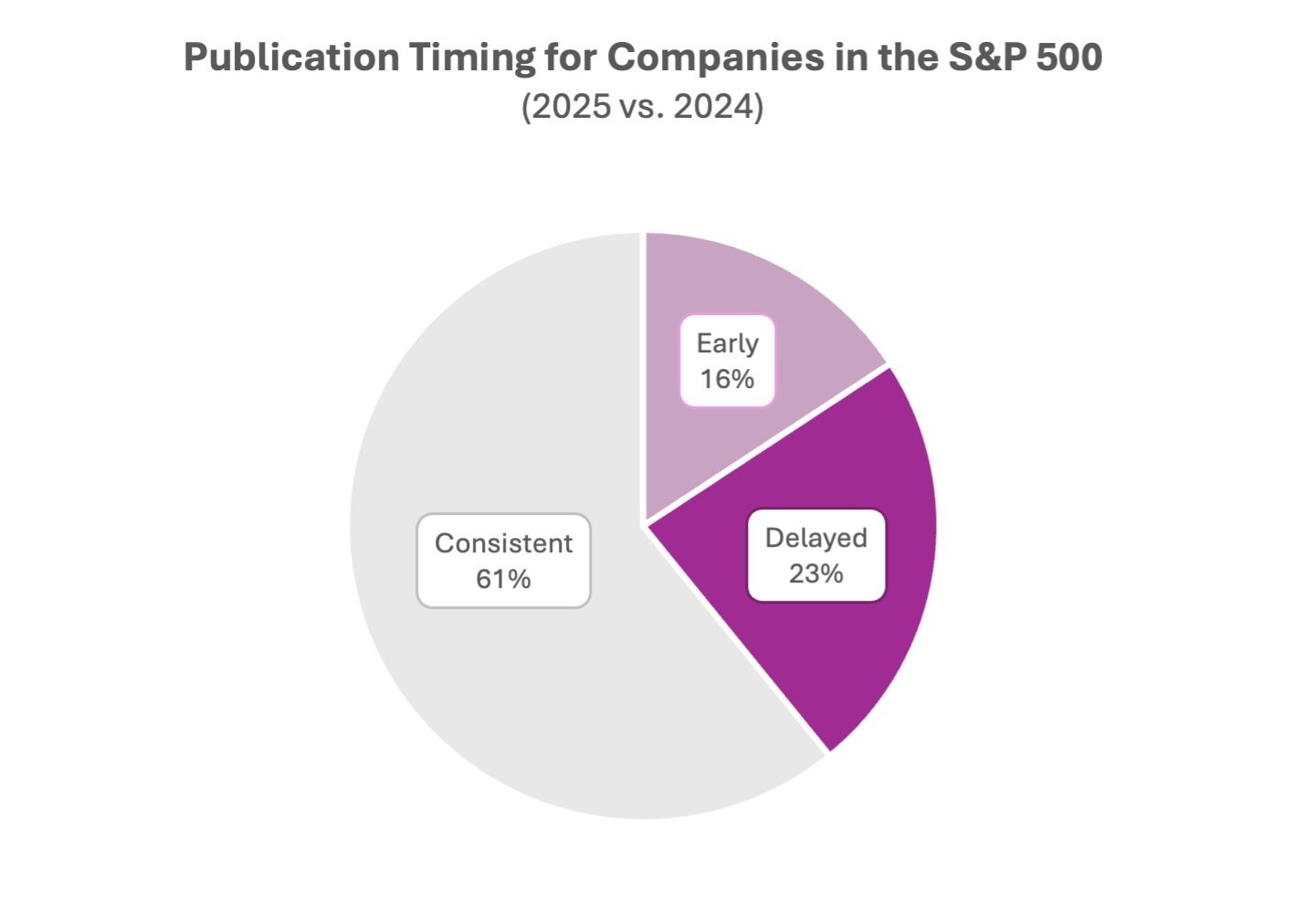

The timing of sustainability reporting is also shifting. Traditionally, the second quarter has seen the highest volume of report releases, but only 36% of S&P 500 companies published reports in the second quarter of 2025, down from nearly 50% the previous year.

About 23% of the sustainability reports published by S&P 500 companies in the first half of 2025 were issued later in the year than they were in 2024. Where a company moved back the timing of its sustainability report, we found an average delay of 1½ months, with some companies delaying publication by up to five months.

In some cases, companies accelerated their timelines: 16% of reports were released earlier in 2025 than they were in 2024. This divergence suggests that some companies are still considering and implementing integrated sustainability reporting, where the sustainability report is prepared and published earlier in the fiscal year on the same timeline as the annual report.

These shifts in timing may reflect a range of additional factors, from reallocating internal resources in preparation for new regulatory reporting requirements, including the European Union's Corporate Sustainability Reporting Directive and the California climate laws. Several companies are also subjecting sustainability reports to higher levels of legal and strategic review, with additional time potentially required to navigate changes to diversity-related disclosure and progress on sustainability goals and commitments.

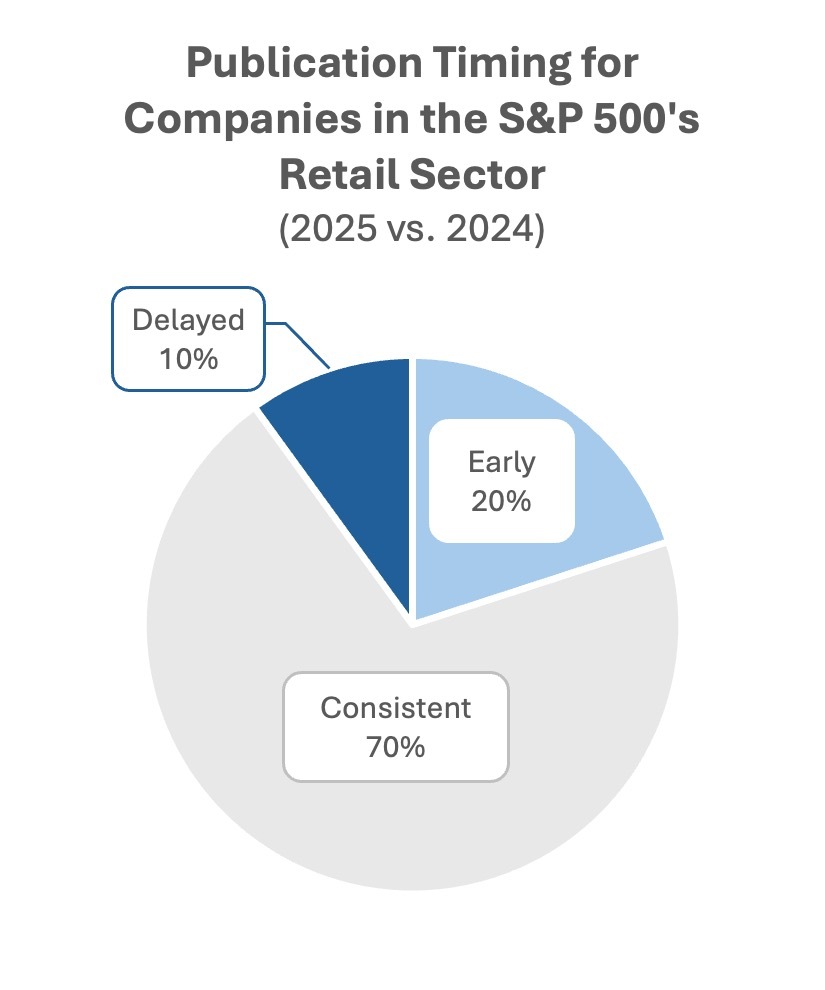

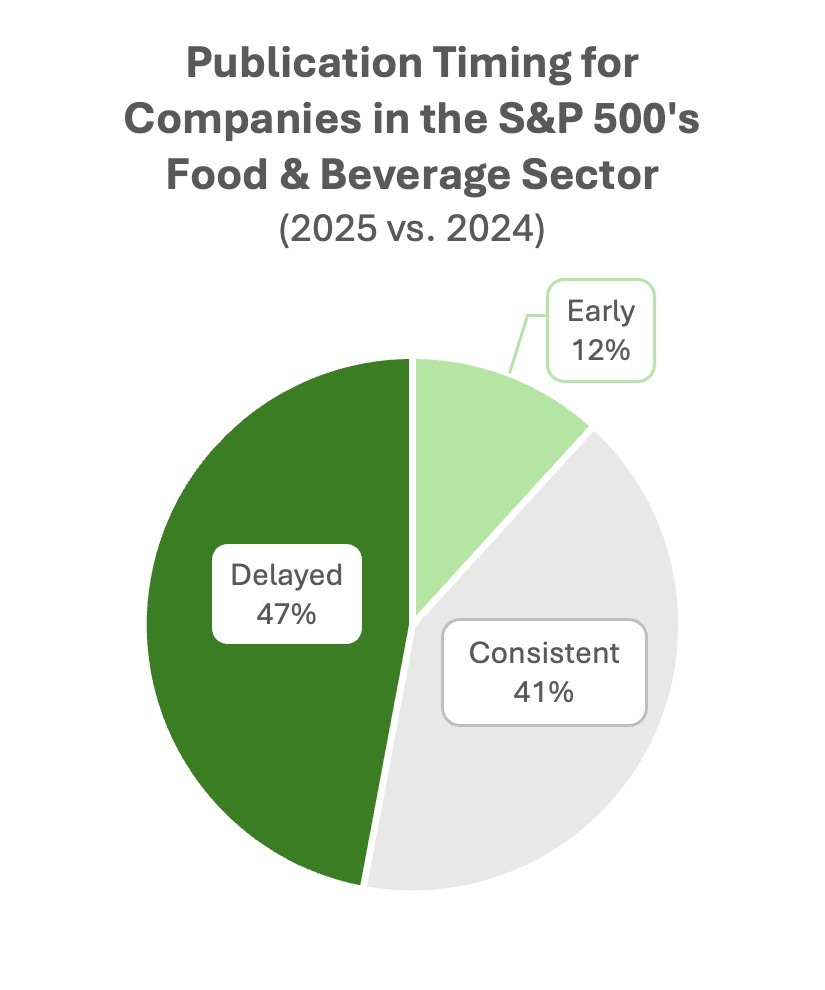

Shifting timelines for sustainability reporting also vary by sector. In the first half of 2025, 30% of companies in the retail sector changed the timing for publishing their report, with 10% reporting later and 20% reporting earlier than in 2024. In the food and beverage and software sectors, about 60% of relevant companies reported on a different schedule in 2025 than they did in 2024, with the plurality of companies in these sectors delaying publication.

Alignment With Frameworks and Standards

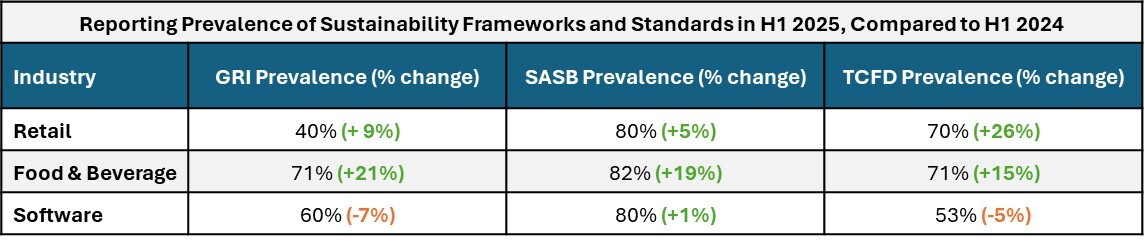

Despite the decline in the number of reports, the proportion of sustainability disclosure aligned with voluntary frameworks and standards generally remained consistent, meaning that companies still publishing reports are generally maintaining or even improving the completeness of their disclosures.

There was a 3% increase in the number of reports released in the first half of 2025 that were aligned with at least one sustainability framework or standard, compared to the first half of 2024. Growing adoption of certain standards and frameworks, including the Global Reporting Initiative standards and the recommendations of the Task Force on Climate-related Financial Disclosures, or TCFD, may reflect efforts by U.S. companies to use their voluntary sustainability reporting efforts to prepare for regulatory requirements.

There was a 7% increase in the proportion of reports published in alignment with the GRI standards across the S&P 500. The GRI standards, which provide an industry-agnostic approach for disclosing relevant environmental, social and economic impacts, share similarities with the Corporate Sustainability Reporting Directive requirements.[5] The increase in GRI-aligned disclosure may reflect efforts by large U.S. companies to prepare for their potential reporting requirements under that regulation.

Overall alignment with the TCFD recommendations,[6] a framework designed to help companies disclose climate-related risks and opportunities, increased by 10%. The TCFD framework is generally expected to inform regulations developed by the California Air Resources Board under its climate-related financial risk disclosure program. Growing disclosure aligned with the TCFD may be a signal that U.S.-based companies are using the framework to prepare for compliance with the California climate laws.

The Sustainability Accounting Standards Board standards,[7] which support industry-based disclosures about sustainability-related risks and opportunities, remain the most widely used, with 84% of reports referencing them in the first half of 2025.

The use of multiple frameworks generally remained consistent. In the first half of 2025, 80% of reporting companies used more than one framework in their most recent sustainability report, most commonly combining SASB standards with another reporting framework or standard. This is compared to 79% of reporting companies in the first half of 2024.

These trends are generally consistent across the retail, food and beverage, and software sectors, with the food and beverage sector showing the largest increase in framework adoption.

While alignment with well-established standards and frameworks has generally increased, we also found limited adoption of new standards and frameworks. While hundreds of global companies have committed to voluntary reporting of nature-related issues in line with the Task Force on Nature-related Financial Disclosures, only seven companies in the S&P 500 referenced the TNFD in a sustainability report published in the first half of 2025.

Adoption of the International Financial Reporting Standards' sustainability disclosure standards S1 and S2 was also limited, with 17 S&P 500 companies publishing data aligned with IFRS S1 and/or S2, and four companies claiming alignment with IFRS sustainability disclosure standards in the first half of 2025.

Strategic Implications

While the overall number of S&P 500 companies with a sustainability report published in the first half of 2025 declined, the alignment of those reports with existing and emerging sustainability frameworks increased. At the same time, the timing of report publication is shifting, with some companies delaying disclosures and others accelerating their reporting schedules.

These shifts have significant strategic implications. The decline in disclosure rates suggests that companies are becoming more selective and intentional about their reporting, focusing on the material topics and audiences that matter most. Meanwhile, increasing alignment with recognized frameworks and evolving publication timelines indicate that companies may be evaluating a move toward more robust and complete reporting.

As more U.S.-based public companies consider changes to their sustainability reporting practices, they should keep the following questions in mind:

- What are the key business drivers for sustainability reporting?

- How will changes to the sustainability report compare to our peer companies?

- What sustainability information is important for our investors?

- What sustainability information is important for our customers and business partners?

- How will changes to our voluntary reporting practices affect readiness for regulatory requirements?

For the broader market, the message is clear: Sustainability reporting is evolving rapidly. Understanding how to balance these changes with the key drivers for sustainability reporting should be part of strategic decision-making about resource allocation, risk management and long-term value creation.

[1] As a benchmark for corporate reporting practices in the U.S. and globally, the S&P 500 provides valuable insights into evolving trends. Our analysis covers sustainability reporting from Jan. 1 to June 30, 2025, compared to the same period in 2024.

[2] The "retail companies" sector contains a select 38 S&P 500 companies in the Consumer Discretionary sector defined by the Global Industry Classification System ("GICS"). These companies sell goods to the public in relatively small quantities for use or consumption rather than resale; this includes GICS subindustries such as apparel retail, general merchandise stores, home furnishings, internet and direct marketing retail, automotive retail, and personal products.

[3] The "food and beverage companies" sector contains a select 30 S&P 500 companies in the Consumer Discretionary and Consumer Staples sectors defined by the GICS. These companies are involved in the processing, packaging, and distribution of food and drinks intended for human consumption; this includes GICS subindustries such as restaurants, agricultural products, food retail, and packaged foods and meats.

[4] The "software companies" sector contains a select 31 S&P 500 companies in the Information Technology GICS sector. These companies design, produce and distribute packaged software; this includes GICS subindustries such as application software, data processing and outsourced services, and systems software.

[5] In November 2023, the GRI and the European Financial Reporting Advisory Group, which is responsible for drafting the technical European Sustainability Reporting Standards (ESRS) under the CSRD, published a GRI-ESRS Interoperability Index, which sets out how the disclosure requirements and datapoints of the GRI and ESRS relate to each other.

[6] Concurrent with the release of its 2023 status report in October 2023, the TCFD has fulfilled its remit and disbanded. The Financial Stability Board has asked the International Financial Reporting Standards (IFRS) Foundation to take over the monitoring of the progress of companies' climate-related disclosures.

[7] As of August 2022, the International Sustainability Standards Board (ISSB) of the IFRS Foundation assumed responsibility for the SASB standards. As stated on its website, the ISSB is committed to maintaining, enhancing and evolving the SASB Standards, and encourages preparers and investors to continue to use the SASB Standards.