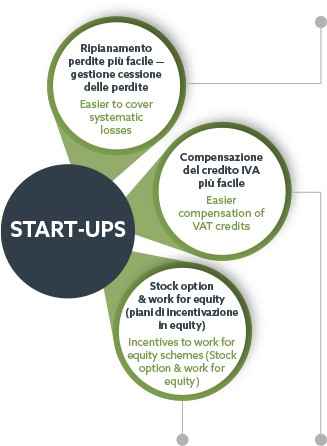

Incentives to work for equity schemes (Stock option & work for equity)

Employees and consultants can be remunerated through stock options and work for equity that are not included in taxable income (taxed as capital gain!). Income deriving from the assignment of financial instruments issued for the contribution of works or services, or credits accrued for the performance of works or services, including professional ones, are not included in the taxable income of the recipients at the time of issue or of credit compensation and cancellation.