People

Search Results

Practice:

- Technology & Innovation Sector

- Compensation & Benefits

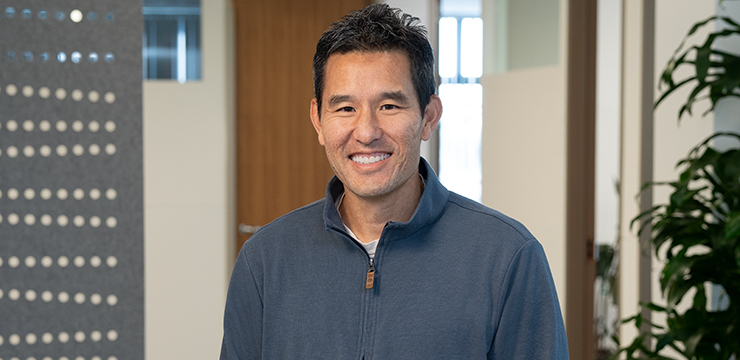

Mike Yang 合伙人

Santa Monica

Mike's practice focuses on the representation of U.S. and international public and private high technology companies, as well as executives, management teams and founders with compensation and employee benefits issues in the context of M&A transactions, spin-offs, venture capital financings and IPOs.

Mike also advises on day-to-day tax, employment, accounting and securities law issues in connection with the design, administration and implementation of executive compensation and equity compensation arrangements, including employment agreements, severance arrangements, change in control carve-out plans, stock option plans and employee stock purchase plans with a particular focus on Code Sections 409A, 280G and 162(m). In addition, he advises on nonqualified deferred compensation arrangements, tax-qualified retirement plans and welfare benefit plans.Prior to practicing law, Mike was a Certified Public Accountant with Ernst & Young.