#FounderTeams in German Start-ups – Part II: Founder Equity Distribution Patterns | Legal Ninja Snapshots

Legal Ninja Snapshots

6 minute read | June.24.2025

Prefer to listen?

Enjoy this text-to-speech recording of this article:

We are excited to share the initial findings from our comprehensive Founder Equity Study 2025.

About the Study

Our research analyzed founder teams and equity distributions across almost 2,200 German start-ups established between 2019 and 2024, each having secured external funding through angel investors or (corporate) venture capital. While our dataset focuses on funded start-ups rather than the entire German start-up ecosystem, it provides valuable insights into team composition, gender distribution, and equity allocation patterns. The analysis tracks developments over multiple years and offers both aggregate and sector-specific perspectives.

OLNS#15

The complete findings will be published in the fifteenth edition of the Orrick Legal Ninja Series (OLNS#15). This comprehensive report will include:

- Detailed data analysis and sector-specific breakdowns

- Comparative analysis with US start-up ecosystem data

- Practical guidance on team composition and equity allocation

- Insights on managing team dynamics and founder transitions

- Expert interviews with leading venture capital investors sharing their perspectives on these crucial founding decisions

This Legal Ninja Snapshot Series

In this two-part mini-series, we present key findings on:

Even and Uneven Splits

The distribution of equity among co-founders represents one of the most crucial and potentially contentious decisions in a start-up's early life. This decision not only reflects the perceived value of each founder's contribution but can also significantly impact team dynamics, motivation, and long-term company success. Our analysis provides empirical insights into how German founders approach this critical decision.

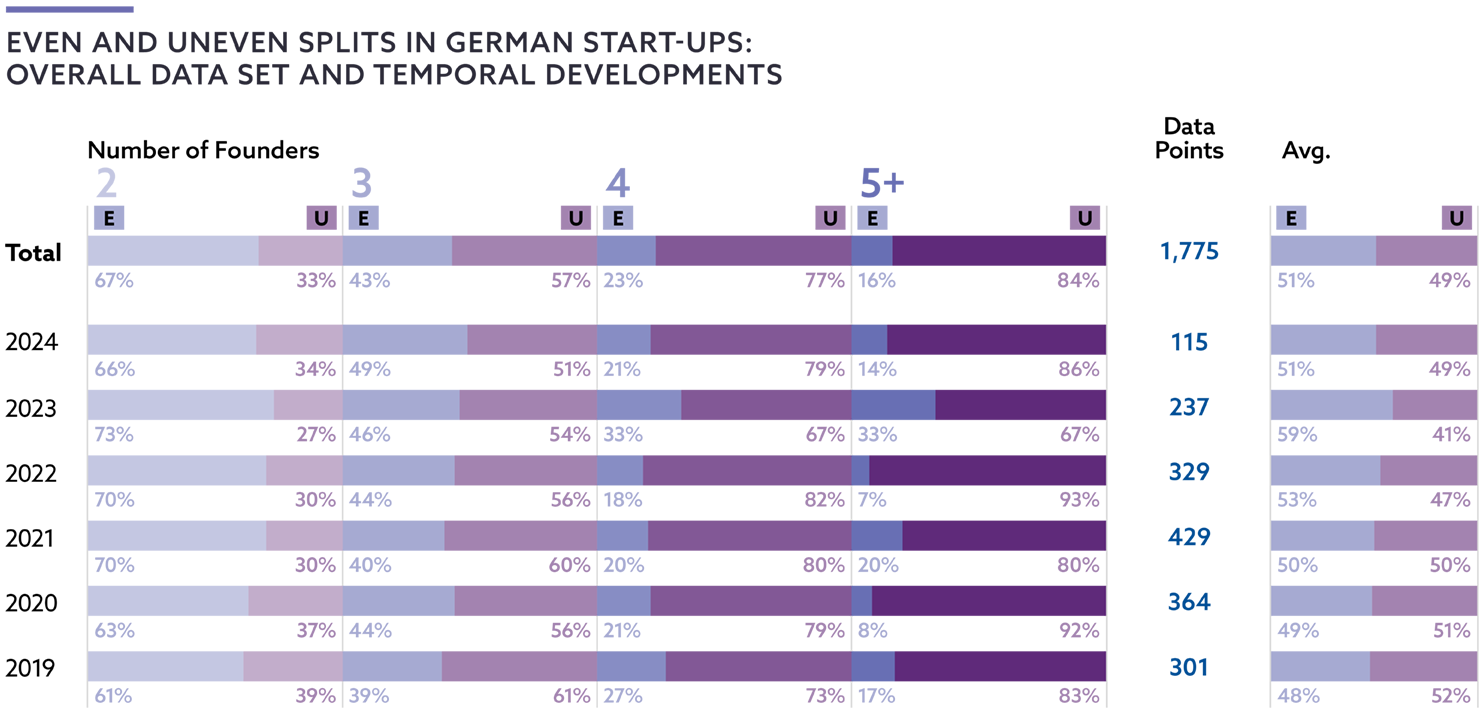

Two-founder teams demonstrate the strongest preference for equal distribution, with 67% opting for even splits. This preference appears deeply rooted and has strengthened over time, increasing from 61% in 2019 to 66% in 2024. The consistency of this pattern across years and sectors suggests that many two-founder teams view equal partnership as the most straightforward and fair arrangement, potentially reducing future conflicts and simplifying decision-making processes.

As team size increases, the complexity of equity distribution grows correspondingly. In three-founder teams, we observe a shift toward uneven splits, which predominate at 57% of cases. However, these teams show interesting temporal dynamics, with the proportion of even splits varying significantly year over year, ranging from 39% to 49%. Notably, recent years show a trend toward more even splits, with 49% of three-founder teams in 2024 choosing equal distribution compared to 39% in 2019.

The preference for uneven splits becomes more pronounced in four-founder teams, where 77% opt for differentiated equity distribution. This strong tendency might reflect the increasing challenge of evaluating and balancing diverse contributions as team size grows. The data shows considerable fluctuation over time, with even splits ranging from 18% to 33%, though no clear temporal trend emerges.

Teams with five or more founders show the strongest preference for uneven splits, with 84% choosing differentiated equity distribution. This pattern appears logical given the complexity of evaluating contributions across larger teams and the increased likelihood of varying levels of involvement or experience among founders. However, the percentages in this category show high volatility, ranging from 7% even splits in 2022 to 33% in 2023, partly due to smaller sample sizes in this category.

The analysis of equity splits from 2019 to 2024 reveals several distinct temporal patterns, both in the aggregate data and across different team configurations.

Looking at the overall development, we observe a gradual shift toward even splits across the analyzed period, with the proportion increasing from 48% in 2019 to 51% in 2024. However, this aggregate trend masks significant variations across different team sizes and years.

- Two-founder teams show the most pronounced shift toward even splits over time. The proportion of even splits in two-founder teams increased steadily from 61% in 2019 to 66% in 2024, with particularly strong numbers in 2023 (73%). This trend suggests an evolving preference for equal partnership structures in two-founder constellations, though the underlying reasons for this shift cannot be definitively determined from our data.

- Three-founder teams show more complex patterns. While uneven splits predominate throughout the period, the proportion of even splits has fluctuated significantly: starting at 39% in 2019, reaching 44% in 2020 and 2022, and increasing to 49% in 2024. This volatility might reflect the inherent complexity of balancing contributions and responsibilities in three-person teams, where factors such as different roles, experience levels, and commitment may influence equity distribution decisions.

- In four-founder teams, we observe substantial year-to-year variations in equity split patterns. The proportion of even splits ranges from a low of 18% in 2022 to a high of 33% in 2023, with no clear directional trend over the analyzed period. This volatility might reflect the increased complexity of equity distribution decisions in larger teams, where multiple factors must be balanced in determining appropriate equity allocations.

- Teams with five or more founders show the most volatile patterns, with the proportion of even splits ranging from 7% in 2022 to 33% in 2023. However, these significant swings should be interpreted cautiously due to the smaller sample sizes in this category, particularly in more recent years. Throughout the period, these larger teams maintain a strong tendency toward uneven splits, suggesting that equal distribution becomes increasingly complex and potentially less practical as team size grows.

For the most recent years (2023-2024), we observe increased volatility across all team sizes. While this might indicate evolving attitudes toward equity distribution, it could also reflect the smaller sample sizes in these years, as our dataset primarily captures VC-backed companies and there is naturally less data available for recently founded start-ups. These temporal patterns suggest that while preferences for equity distribution have shifted somewhat over time, the fundamental relationship between team size and split patterns remains relatively stable: smaller teams tend toward even splits, while larger teams predominantly opt for differentiated equity distribution. The year-to-year variations we observe might reflect changing market conditions, evolving founder preferences, or other external factors not captured in our dataset.

Equity Distribution Patterns in Teams with Uneven Splits

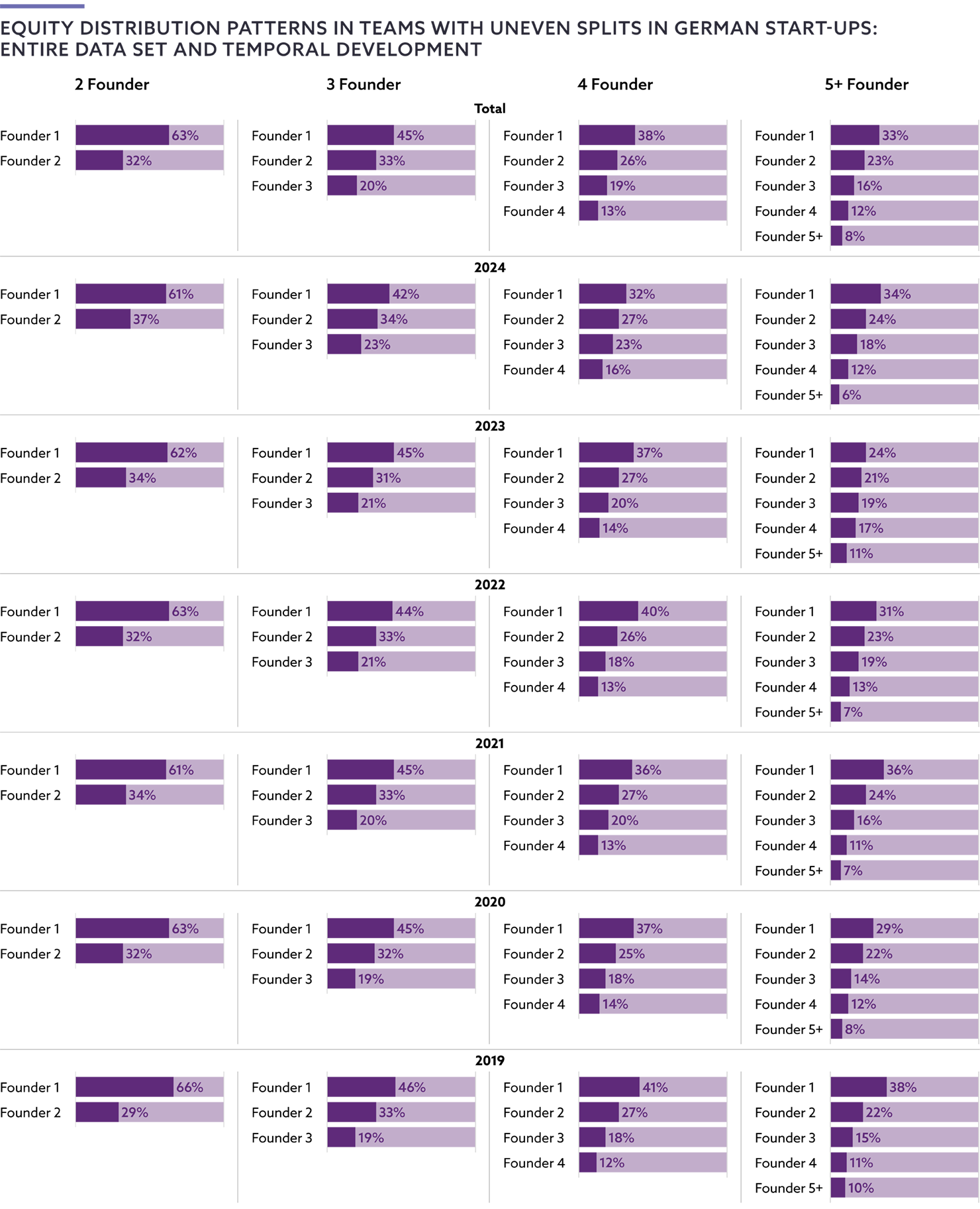

Having established when teams opt for uneven splits, we now turn to examining how founding teams actually distribute equity in these cases.

Our analysis focuses on the average shareholdings of each founder in teams that chose uneven splits, ranked from highest to lowest shareholding. We examine these patterns across different team sizes. Our findings reveal distinct patterns in how founders distribute equity in uneven splits, suggesting certain "standard" approaches that vary by team size and sector. These patterns range from modest divergences from equal splits to more pronounced differences in equity allocation, particularly in larger teams.

Please note that the numbers in the table below might not add up to 100% for a variety of reasons, e.g., the calculation of averages and rounding of numbers and non-founders on the initial cap table (e.g., business angels, incubators or corporations in case of corporate spin-outs).

Overall, we identified the following notable trends:

- Two-founder teams show the most stable patterns across all years.

- Larger teams demonstrate increasing volatility in more recent years.

- The basic hierarchical structure remains consistent throughout the period.

These patterns suggest that while founding teams have developed certain "standard" approaches to uneven equity splits, the specific distribution often depends on team size and potentially other factors we will explore in subsequent analyses. The relative stability of these patterns over time, particularly in two-founder teams, might indicate established best practices in the German startup ecosystem.

Again, in OLNS#15 we publish sector-specific breakdowns and explore whether and how gender composition influences the specific distribution of equity in uneven splits, adding another dimension to our understanding of equity allocation practices.