Acquiring a Distressed Private Technology Company – A Roadmap

May.13.2020

After years of sky-high valuations, private equity funds and strategics will have ample opportunity to buy technology companies at a discount in the wake of the COVID-19 crisis. This article highlights the unique opportunities and risks associated with acquiring a distressed private technology company.

Finding Deals & Identifying Decision Makers

In addition to traditional sourcing outlets, buyers can access potential targets by purchasing debt and other claims from existing creditors on the secondary market. If done thoughtfully, a buyer can transform itself from a hopeful outside bidder into a creditor armed with special rights. Specifically, being a creditor may enable buyers to utilize information and inspection rights contained in credit agreements to enhance due diligence and implement special legal structures to complete an acquisition, as discussed further below.

Once a target has been selected, buyers should take care in identifying the “real” decision makers. This analysis is typically straightforward in the non-distressed context because the board, management team and key stockholders can usually negotiate and approve a deal, while creditors are simply repaid. However, in the distressed context, creditors are an additional and important stakeholder group that can dictate terms. What’s more, buyers targeting companies with tiered debt structures and syndicated loans must navigate a web of liens, covenants, remedies and intercreditor agreements to determine which creditor (or group of creditors) are needed to approve a deal.

Selecting a Structure

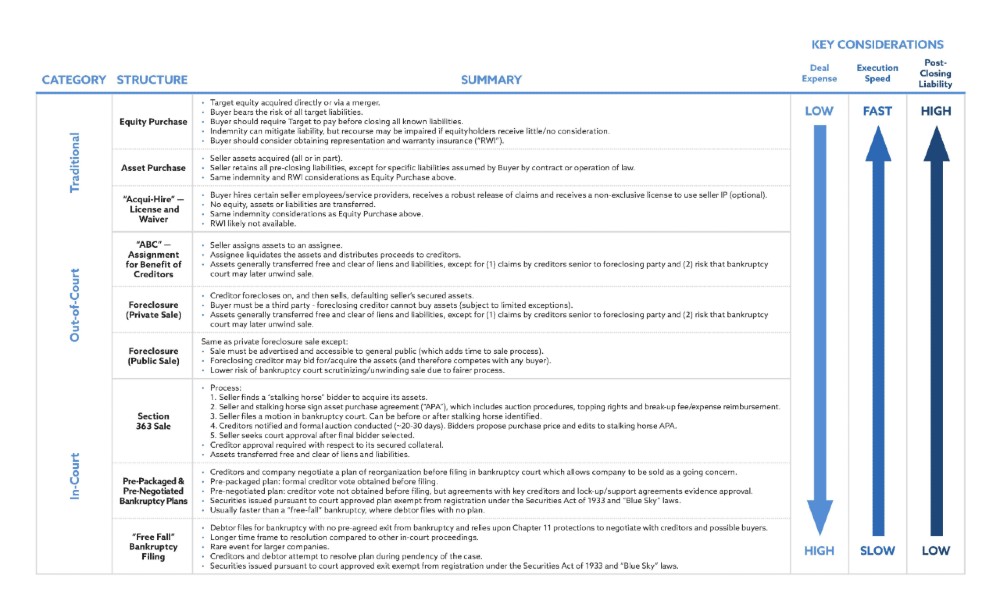

Distressed deals can use traditional acquisition structures or creditor-driven structures outside of or through bankruptcy court (“out-of-court” versus “in-court”). As summarized below, each structure carries different levels of deal expense, execution speed and post-closing liability risk. Post-closing liability risk typically centers on fraudulent transfer claims by aggrieved creditors or a bankruptcy court’s order to recover certain payments made by a debtor before a bankruptcy filing.

Getting the Deal Done

Once a structure has been selected and the parties are in execution mode, buyers should take ownership of the following issues in the sprint to closing. Buyers cannot assume that a seller’s management team will be invested in the transaction or properly focused on these issues because they will likely receive sub-optimal deal consideration or just abandon a “sinking ship” altogether by resigning. Also, unlike a non-distressed deal, buyers will likely have limited or no recourse against selling securityholders for post-closing claims or liabilities. Put simply, many seller problems become buyer problems.

- Fiduciary Duties. As with any potentially contentious deal, the parties should ensure that the seller’s directors and officers fulfill their fiduciary duties in order to avoid creditor and stockholder claims that may scuttle a deal or haunt buyers for years after closing. This is especially important in conflicted transactions where an existing stockholder or creditor is the buyer or receiving special treatment. See this article for a brief discussion of fiduciary duties and risk mitigation tools for conflicted transactions, such as the use of independent committees, informed stockholder votes and independent valuations and opinions.

- D&O Insurance, Exculpation & Indemnification. In addition to taking the foregoing front-end precautions to reduce fiduciary claim risk, the parties should also ensure that the seller’s organizational documents properly insulate directors and officers with exculpation, indemnification and advancement provisions and that those obligations are adequately back-stopped with robust D&O insurance.

- Transition Services. Buyers must carefully consider which transition services will be needed after closing. These costs may be substantial and impact overall deal pricing because sellers may be unable to provide any transition services and the entire workforce may be terminated at closing.

- Employee Compensation. Buyers should cause Sellers to pay in full all wages and other amounts due to employees. In addition to severe reputational damage and harm to employees, directors and officers may face personal liability under federal and state wage and hour laws for earned but unpaid wages.

- WARN Act. The Worker Adjustment and Retraining Notification (WARN) Act requires employers with 100 or more employees to provide at least 60 days’ advance written notice before a mass layoff affecting 50 or more employees. Some states, such as California, have their notification rules. Although these rules may seem simple, a technical analysis is required to determine if previous pre-closing layoffs are counted towards any layoffs that are planned at closing.