Future Fund: FAQs

May.22.2020

#TeamOrrick thanks the nearly 200 people who attended our webinar on Wednesday morning on the #FutureFund convertible loan notes. We tried to answer all of your questions, but they kept on coming, so here is the promised FAQ based upon the most common questions asked by attendees and others that we have received since.

A Eligibility

-

The eligibility criteria, together with details of the application process are available to review at www.uk-futurefund.co.uk. One new criterion added since the publication of the headline terms dated 20 April 2020 as summarised here (the "Headline Terms") is that the Investee Company must have been incorporated on or before 31 December 2019.

-

In order to be eligible, at least half of the Investee Company's employees must be UK based or at least half of the Investee Company's revenues must be from UK sales. Whilst there is currently no clarity on how the revenue from UK sales is to be calculated, we understand that the Investee Company's most recent annual accounts will be the correct reference point.

-

The Headline Terms suggested that to be eligible, only the ultimate parent company which is itself UK registered would be eligible and this position has been retained. However, we understand that a carve-out to this rule may soon be announced in respect of those UK companies that may have 'flipped', notably to Delaware, in order to participate in an accelerators program.

-

The £250,000 must have been raised through the primary issue of shares for cash in the period 1 April 2015 – 19 April 2020 (effectively within the five years prior to announcement of the Future Fund scheme). Unconverted ASAs, SAFEs or convertible loan notes will therefore not qualify.

The £250,000 must have been raised from third-party investors (i.e. institutional funds or angel investors) and funds raised from founders, employees, workers and consultants will not count. Also excluded are their "connected parties" such as family members, trusts or controlled companies. The FAQ provided by the Future Fund do clarify that investment from a non-executive director who has been appointed as an "investor-director" can count towards the £250,00 threshold (and will be eligible for matching).

-

If a company has previously received S/EIS or VCT investment, this will not be negatively affected at the time of taking the convertible note or where the convertible loan ultimately converts into shares. A negative impact would apply where the note redeems, and consequently the government has indicated that it intends to make changes to the rules to clarify that this should not be the case.

-

As with any convertible debt, the Future Fund convertible loan note will not be EIS compliant. As a result, an investor will not be able to enjoy EIS reliefs in respect of its participation in the Future Fund convertible loan note, but this does not preclude them from participating on the same terms (and for their investment to be matched by the Future Fund), although such investors should take their own tax advice as to the consequences of their participation. In particular, we note that doing so will restrict that investor from obtaining EIS relief in that company in the future, once the convertible loan notes convert into shares. There is no negative impact on the EIS investor's ability to make EIS investments in other companies and no negative impact on the Investee Company to take EIS compliant investment from other EIS investors.

VCTs only require 80% by value of their investments to be in qualifying holdings, of which at least 70% by value of those qualifying holdings must be in eligible shares. The Future Fund convertible loan note will not be a qualifying holding (because at least one of the requirements is not met, since it is for a duration of less than five years), but the shares arising on conversion of the loan may be eligible shares. As a result, subject to its individual circumstances, a VCT may be able to participate in the Future Fund scheme and for that investment to be matched by the Future Fund.

The above comments are in the nature of general commentary only and do not purport to provide advice on the tax position of any investor or company that may wish to participate in the Future Fund scheme. Any prospective investors in the Future Fund scheme should seek their own independent tax advice on the tax implications of acquiring, holding, converting and disposing of Future Fund convertible loan notes and the shares arising on conversion. Any EIS or VCT qualifying companies should seek their own independent tax advice on the tax implications of participating in the Future Fund scheme.

-

There is no intention to have an advance assurance process, in part due to the simplicity of the investor led application process (see Section E below) and the short term/immediate perspective of the Future Fund. An application should only be made once matched investors have been found and all parties are ready to close.

-

No, the eligibility criteria have clarified that the scheme will not apply to an Investee Company that has any of its shares or other securities listed/quoted on a regulated market, a multilateral trading facility, a recognised investment exchange and/or any other similar market, stock exchange or listing venue.

-

Yes. Companies that have received other types of Government aid related to COVID-19 are not excluded from applying to the Future Fund.

B Matched Funding

-

No. The intent is to support companies that might not otherwise be able to raise funds given the C-19 uncertainty and turmoil. As a result, retrospective application is not permitted.

-

The matched funding must be on exactly the same terms and structure as the Future Fund. The Future Fund does not have the intent or capacity to individualise the approach for each company. There is also comfort derived from the premise that the Future Fund and the matched investors have an aligned interest through an identical instrument.

-

In order to participate, an investor must be eligible to subscribe for the convertible loan note by falling into one of the categories of participants listed in Section 10a of Schedule 1 of the convertible loan note instrument (set out on page 11 of the convertible loan note instrument here). All investors then qualify for matching by the Future Fund, other than a specific category of "connected persons” (as defined in the Corporation Tax Act 2010) – broadly speaking, controlling shareholders.

-

Yes. In a clarification of the original guidance, the Future Fund has confirmed that a founder, employee, worker or consultant of the company can participate in a Future Fund investment and that her/his investment will be eligible for matching by the Future Fund (so long as they are not restricted as set out in the answer to Question 12 above). Their previous investments will however remain ineligible to count towards the £250k prior raise threshold, as noted in response to question 4 above. Helpfully, that person can also act as the Lead Investor for the purposes of submitting the application, so long as their investment is for £12,500 or more. However, the Lead Investor should not also be the nominated director that signs the director’s certificate on behalf of the Investee Company.

-

The application process requires the matched investors to have transferred their subscription monies to the Investee Company's solicitor's account prior to release of the Future Funds subscription monies being made available.

Should the matched investors and the Investee Company elect, there will be an ability for the Investee Company to raise further funds under the convertible loan note in the 90 days after the Future Fund has invested. However, those additional funds will not be matched by the Future Fund. As a result, Investee Companies and matched investors may face a difficult trade-off in wanting to wait until all possible investors are ready to fund (in order to maximise the matched amount) versus wanting to confirm a successful application as soon as possible.

-

The actual investment must take place after the programme is live as an application cannot be made for retrospective funding; a signed term sheet alone (with no completed definitive documentation) would therefore not prevent an application.

C Headline economic terms

-

A reminder of our earlier briefing can be found here and the Headline Terms remain the same, including:

- £ for £ matched funding of between £125,000 and £5,000,000;

- conversion is at a Discount Rate of 20% (or a higher rate as may be agreed between the Investee Company and the matched investors).The Discount Rate will not apply to a conversion of interest or to a conversion which is by reference to a financing round prior to 20 April 2020;

- an Interest Rate of 8% per annum (non-compounding) (or a higher rate as may be agreed between the Investee Company and the matched investors), payable on conversion of convertible loan notes (without the Discount Rate applied) or repaid (at the option of the Investee Company).Interest is not payable on a redemption of the convertible loan notes;

- no valuation cap, unless one is agreed between the Investee Company and the matched investors;

- if there is a desire to allow flexibility to issue further convertible loan notes on the same terms within the following 90 days, how much headroom is proposed;

- automatic conversion on a "qualified financing" (being an equity financing of an equivalent or higher value to the aggregate amount of convertible loan notes issued under the Future Fund scheme) and voluntary conversion at the election of matched investors (by principal amount of convertible loan notes held) on any other financing into the most senior class of share issued on such financing;

- a maturity date of 3 years, at which conversion into the most senior class of share then in issue occurs or, at the option of matched investors (by principal amount of convertible loan notes held) or the Future Fund (in respect of itself), repayment with a 100% premium.There is no ability to repay any note early without the consent of each participant and this is not an anticipated outcome;

- on an exit by way of sale or IPO, conversion will occur subject to noteholders receiving a minimum return equal to the principal value of the convertible loan notes held plus a 100% premium; and

- the application of a most favoured nation provision in the event that the Company issues:

- whilst any convertible loan note remains outstanding, any other unsecured loan notes or advance subscriptions on terms more favourable than those contained in the Future Fund convertible loan note; or

- for six months after conversion of the convertible loan notes, any further securities which are on terms more favourable than those upon which the convertible loan notes converted.

-

No, the Future Fund scheme and loans issued under it will be sterling denominated. The convertible loan note does include a mechanism for currency conversion in the event of a future conversion by reference to a fundraising denominated in a currency other than sterling.

D Other governance terms

-

The definitive document has clarified that there will be no restriction on the continued servicing of third-party debt, such as bank or venture debt. However, there is still a restriction on:

- the repayment of existing shareholder and connected party loans;

- the payment of any dividends or other distributions;

- in the 12 month period from the date of the convertible loan note instrument, the payment of any bonus or other discretionary payment to any employee, consultant or director of the company other than as contracted prior to the date hereof and as paid by the company in the ordinary course of business; and

- the payment of any advisory or placement fees or bonuses to any corporate finance entity or investment bank or similar service provider on monies advanced by the Future Fund.

-

Schedule 4 of the convertible loan note instrument contains a detailed list of the Future Fund specific information rights required both prior to redemption or conversion of the loan note and after conversion, for so long as the Future Fund holds any shares.

-

This can be provided for in any documentation separately agreed between matched investors and the company as long as it does not override the terms of the Future Fund convertible loan note or change the economics for any party.

-

The intent is that the loan notes will be transferable by the holders as if they were equity under the Investee Company's articles of association and so individual consent from participants will not be required.

An additional transfer provision has been built in to permit the government to transfer its commitment to associated government entities and as part of a portfolio of interests in not less than 10 companies.

E Application process

-

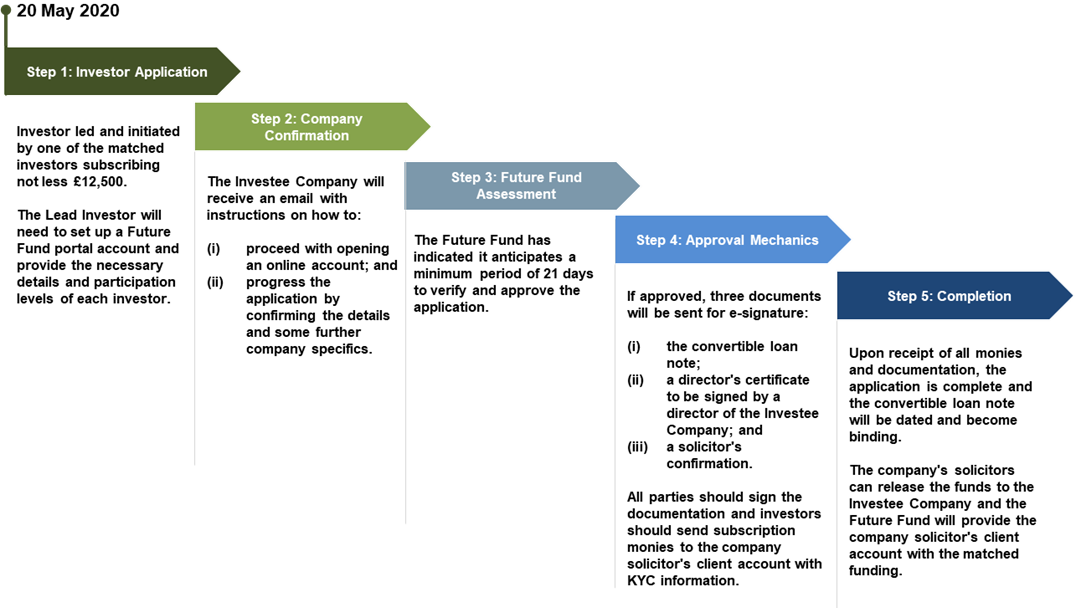

OVERVIEW OF THE FUTURE FUND APPLICATION PROCESS

FULL DETAILS OF THE FUTURE FUND APPLICATION PROCESS

Step 1: Investor application

The application portal opened at www.uk-futurefund.co.uk at 8:00am on Wednesday 20 May 2020. The application process is investor led and is initiated by any one of the matched investors subscribing not less £12,500, termed the Lead Investor. Where an Investee Company has more than one matched investor, there is no specific requirement as to who should take this role provided that investor is subscribing for not less than £12,500 of notes – specifically, it does not need to be the largest investor. Other than completing the application process, there is no additional obligation or ongoing liability taken on by the Lead Investor.

The Lead Investor will need to set up a Future Fund portal account in order to apply and the application form must include:

- name and contact details for the Investee Company;

- details of the total amount of funding proposed to be raised under the convertible loan note, along with contact details and amounts to be invested by each individual investor including the Lead Investor;

- amount of the loan requested from the Future Fund;

- the stage of equity financing of the Investee Company;

- a statement as to whether the Lead Investor has previously invested in the Investee Company; and

- the reason for applying for a loan from the Future Fund and the intended use of the loan.

The Lead Investor will need to provide the necessary KYC information in relation to each investor so it is useful to have this collated in advance. The Future Fund website sets out in detail what information will be required and needs to be made available.

Step 2: Company confirmation

Once a Lead Investor has submitted the Application, the Investee Company will receive an email with instructions on how to (i) proceed with opening an online account; and (ii) progress the application by confirming the details supplied, the intent to continue the Application and some company specific details, such as turnover and number of employees in the past two financial years.

Step 3: Future Fund assessment

The Future Fund has indicated it then anticipates a minimum period of 21 days to verify the Application and confirm whether it has been approved.

Step 4: Approval mechanics

If the Application is approved, three documents will be sent for electronic signature:

- the convertible loan note in the form published here, populated with all details of the Investee Company and each investor as provided;

- a director's certificate in the form published here, to be signed by a director of the Investee Company confirming the details of the application, the company's eligibility and ability to enter into and perform the convertible loan note; and

- a solicitor's confirmation in the form published here, to be signed by the Investee Company's solicitors, confirming that they hold the subscription monies from all investors (other than the Future Fund) in their client account.

All parties should sign the relevant documentation and the investors (other than the Future Fund) should send their subscription monies to the company solicitor's client account together with relevant KYC information.

Step 5: Completion

Upon receipt of all monies and all signed documentation, the application is complete and the convertible loan note will be dated and become binding. The company's solicitors will be able to release the funds held to the Investee Company. The Future Fund will then fund the company solicitor's client account with the matched funding (no specific timeline has been provided for this), which can be released to the Investee Company immediately once received.

-

The scheme will work on a first-come first-served basis (providing the eligibility criteria is met) and so an early application which is clean and eligible should be processed quicker than a late application which is rejected and takes a while to rectify. However, it is anticipated that the size of the fund will be increased from the initial £250m, should there be sufficient worthy demand.

There will be controls in place "to reduce privileged access by more advanced potential investors". To the extent that a single Lead Investor submits applications in respect of more than one Investee Companies on the same day as there is a high volume of other applicants, only one of those applications may be processed that day. As a result, we would suggest that a Lead Investor is selected, where possible, who will not be submitting multiple applications on the same day.

In addition, the application process does not make any distinction on the size of investments, so larger amounts will not be processed any quicker or slower nor will application amounts will be scaled back.

-

Although not explicitly provided for, under the current mechanism if the Future Fund does not approve the application or does not fund for any other reason, there is no binding obligation on any party and any money already transferred to the Investee Company solicitor's client account should be returned.

-

If an investor fails to complete on its proposed investment or is deemed not to be eligible by the Future Fund, the Application will be rejected. Whilst a compliant application might be resubmitted, it is likely that the minimum 21 day period will be restarted.

The risk of an Application failing as a result of one or more of the proposed matched investors failing to complete on its investment in the intervening period is heightened by the extended period. Orrick is working with its clients to implement mechanisms to protect Investee Companies and investor syndicates from such failed applications. We recommend companies and their investors discuss options for alternative outcomes in the event that the Future Fund application is not approved.

-

No negotiation of terms of the convertible loan note from the standard form published will be possible, other than setting of the commercial terms noted at questions 16(b) - 16(e) above.

The Future Fund scheme specifically mandates an Investee Company to engage company solicitors to implement the closing mechanics. There will, of course be additional areas where Orrick can add value as regards helping you understand and navigate the commercial terms, including how your individual circumstances may be impacted by the Future Fund or may need to be amended to allow for the Future Fund. You may also need our support in ensuring appropriate board and shareholder authorities to implement the scheme.