Tough Legacy Made Easy: An Overview of the Federal LIBOR Legislation

March.18.2022

On March 15, President Biden signed, as part of a larger appropriations act, legislation known as the “Adjustable Interest Rate (LIBOR) Act,” which addresses “tough legacy” contracts[1] that do not provide for the use of clearly defined or practicable replacement benchmark rates when LIBOR is discontinued. This development was welcomed by the market as it inches towards LIBOR discontinuation. Although certain states – most notably New York – have passed or are considering passing similar legislation, this federal legislation expressly supersedes “any provision of any State or local law, statute, rule, regulation, or standard” and establishes a uniform process, on a nationwide basis, for replacing LIBOR in tough legacy contracts.

For the past several years, market participants have been amending their existing LIBOR contracts to build in fallbacks that contemplate the discontinuation of LIBOR.[2] These mitigation efforts became more urgent in March 2021 when ICE Benchmark Administration Limited, the current administrator of LIBOR, announced that it would no longer publish U.S. dollar LIBOR for overnight, 1-, 3-, 6- and 12-month tenors after June 30, 2023.[3] LIBOR serves as the benchmark for trillions of dollars worth of instruments and, as that date approached, concerns persisted about the potential for market disruption and potential litigation, especially in connection with contracts that are not easily amended.

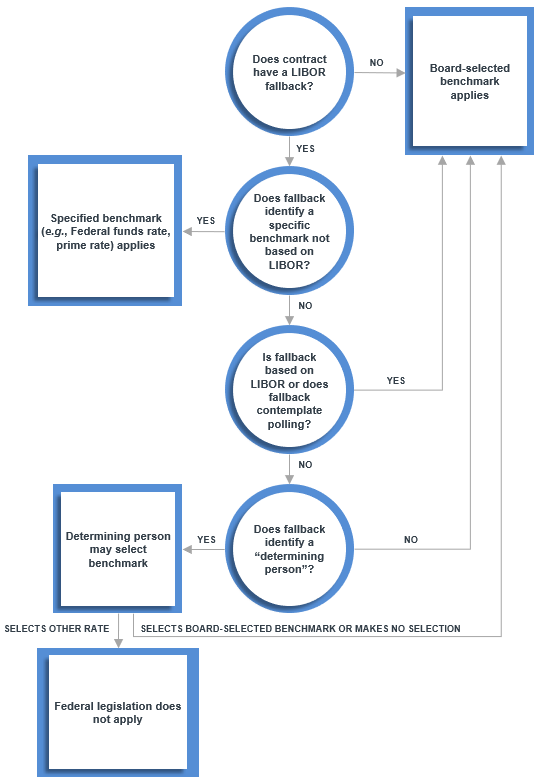

At its core, the federal legislation provides that, if a LIBOR contract either (i) contains no fallback provision or (ii) contains a fallback provision that identifies neither (x) a specific benchmark replacement nor (y) a “determining person,”[4] then on the “LIBOR replacement date”[5] the “Board-selected benchmark replacement”[6] will automatically replace LIBOR.[7]

The federal legislation does not apply where a fallback provision identifies a benchmark replacement that is not based in any way on LIBOR (for example, the Federal funds rate or the prime rate). Fallbacks based on LIBOR or that require a person (other than a benchmark administrator) to conduct a poll, survey or inquiries for quotes or information concerning interbank lending or deposit rates are to be disregarded and deemed null and void.

If a determining person is identified in a fallback, then that person may (but is not compelled to) select the Board-selected benchmark replacement as the replacement rate. If it selects the Board-selected benchmark replacement, then such a selection will be (i) irrevocable, (ii) made by the earlier of the LIBOR replacement date and the latest date for selecting a benchmark replacement under the contract and (iii) used in determinations of the benchmark under the contract on and after the LIBOR replacement date. However, if a determining person selects a benchmark other than the Board-selected benchmark replacement as the replacement rate, then the federal legislation will not alter the terms of the contract. Finally, if a determining person makes no selection by the earlier of the LIBOR replacement date and the latest date for selecting a benchmark replacement under the contract, then the Board-selected benchmark replacement will apply on and after the LIBOR replacement date.

The selection or use of a Board-selected benchmark as a benchmark replacement under the federal legislation will constitute, among other things, a commercially reasonable replacement for and a commercially substantial equivalent to LIBOR, as well as a reasonable, comparable, or analogous rate, index, or term for LIBOR. Moreover, the selection or use of a Board-selected benchmark as a benchmark replacement will not (i) be deemed to impair or affect the right of any person to receive a payment, or to affect the amount or timing of such payment, under a contract or (ii)(w) discharge or excuse performance under a contract for any reason, claim or defense, including any force majeure or other provision in a contract, (x) give any person the right to unilaterally terminate or suspend performance under a contract, (y) constitute a breach of a contract or (z) void or nullify a contract.

The federal legislation does not alter or impair any written agreement specifying that a contract will not be subject to the legislation. Also, no person will be subject to any claim or have liability for damages arising out of the selection or use of a Board-selected benchmark replacement or the implementation of related conforming changes, which provides a safe harbor for determining persons.

In addition, the federal legislation amends the Trust Indenture Act of 1939 such that the right of any holder of any indenture security to receive payment of principal and interest “shall not be deemed to be impaired or affected by any change occurring by the application of [the federal legislation] to any indenture security.”

The Board is to promulgate regulations to carry out the federal legislation within 180 days of its enactment.

The federal legislation received strong bipartisan support and robustly addresses LIBOR transition risks inherent in tough legacy contracts. The chart below provides a simplified decision tree based on the federal legislation.[8]

[1] The federal legislation uses the term “LIBOR contract”, which is defined broadly to include contracts, agreements, indentures, organizational documents, guarantees, mortgages, deeds of trust, leases, securities (whether debt or equity), instruments or other obligations or assets that, by their terms, use LIBOR as a benchmark.

[2] One important industry effort in this regard was led by the International Swaps and Derivatives Association, Inc., which consulted with its membership and the market over several years and arrived at a uniform way to address LIBOR discontinuation in new and legacy swap contracts.

[3] The 1-week and 2-month tenors of U.S. dollar LIBOR were discontinued at the end of 2021.

[4] This term is defined to mean “any person with the authority, right, or obligation . . . to determine a benchmark replacement” with respect to any LIBOR contract.

[5] This term is defined to mean “the first London banking day after June 30, 2023, unless the Board determines that any LIBOR tenor will cease to be published or cease to be representative on a different date.”

[6] This term is defined to mean “a benchmark replacement identified by the Board that is based on SOFR, including any tenor spread adjustment [as specified in the legislation].” Unlike the New York legislation, the federal legislation specifically refers to the adjustments to SOFR that were established in March 2021 (e.g., 0.11448% for 1-month LIBOR and 0.26161% for 3-month LIBOR) to, generally, account for the credit spread difference between LIBOR and SOFR so that SOFR will more closely approximate LIBOR upon transition.

[7] The Board of Governors of the Federal Reserve (as used in the federal legislation, the “Board”) is responsible for making certain important determinations under the legislation.

[8] Note that this chart provides general guidance only and, among other things, does not address the dates a particular benchmark becomes applicable under a LIBOR contract or similar matters.