The New CDP Reporting Process: Key Changes, Insights and Action Items

8 minute read | June.03.2024

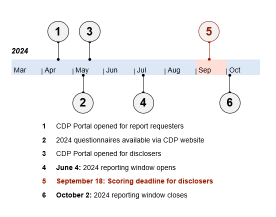

Anticipated Timeline for 2024 CDP Reporters

About CDP

CDP, formerly known as the Carbon Disclosure Project, is a global non-profit that runs the largest voluntary environmental reporting platform in the world. Reporting companies disclose detailed information about their approach to sustainability governance, strategy and risk management to CDP on an annual basis, covering topics including climate change, forests and water security. In 2023, more than 23,000 companies representing two thirds of global market capitalization reported environmental data to CDP. This includes 73 percent of the S&P 500.

Key corporate stakeholders use CDP data, including investors and major customers. Over 700 financial institutions with more than $142 trillion in assets under management use CDP to collect sustainability data from their portfolio companies. Additionally, over 330 major corporate buyers with more than $6.4 trillion in annual procurement spend use CDP data to assess and manage sustainability risks and opportunities in their supply chains. While CDP reporting is voluntary, many companies are urged by key stakeholders to report to CDP, and these requests are often difficult to disregard.

Key Takeaways

- The 2024 CDP questionnaire has a significantly revised scope and structure, including an integrated questionnaire addressing climate, forests, water security, biodiversity and plastics.

- The 2024 CDP questionnaire will significantly increase the number of companies asked for data on forests and water security.

- Companies should ensure that sufficient resources are available to review and validate responses to the 2024 CDP questionnaire— and to ensure alignment with upcoming regulatory disclosures.

The 2024 CDP Questionnaire

CDP has released significant changes to its reporting process for 2024. Every year, CDP increases the ambition of its disclosure framework, and the changes implemented for the 2024 reporting period bring big challenges for reporting companies. For sustainability and legal teams in particular, the revised CDP reporting process may put a strain on existing resources, which are likely already working to address new sustainability disclosure laws and regulations.

Companies responding to the 2024 CDP questionnaire should take steps to prepare for the new process, including steps to manage legal risks and avoid inconsistencies between CDP disclosure and compliance‑driven reporting.

In this client alert, we identify key changes in the revised questionnaire, related data insights that provide a view into current market practice and action items for companies that plan to prepare a response to CDP.

Key Changes to the CDP Reporting Process

CDP has significantly revised the reporting process for 2024, with key changes to the scope and structure of the 2024 CDP questionnaire including:

-

CDP’s three previous questionnaires— climate, water security and forests— have been integrated into a single questionnaire, and questions have been added that address other sustainability topics. Rather than opt-in to separate water- and forest-related questionnaires, companies will now be prompted to provide disclosure on forests and water security in the integrated questionnaire based on an impact assessment methodology developed by CDP. The new process uses self-reported company activities, both directly and in the value chain, and associated revenues to identify companies that likely have critical water- and forest-related exposures.

This application of CDP’s impact assessment methodology will significantly increase the number of reporting entities asked for data on forests and water security.

Percentage of U.S.-based CDP reporters that could be asked to provide disclosure on Water Security

Percentage of U.S.-based CDP reporters that could be asked to provide disclosure on Forests

49% 17% In 2023, only 21 percent of worldwide CDP reporters responded to the Water Security questionnaire. Based on our review of CDP’s impact assessment methodology, over 49 percent of U.S.-based CDP reporters will likely be requested to provide data on water security in 2024, including up to 57 percent of the companies in the S&P 500 that are already CDP reporters. In 2023, only 5 percent of worldwide CDP reporters responded to the Forests questionnaire. Based on our review of CDP’s impact assessment methodology, over 17 percent of U.S.-based CDP reporters will likely be requested to provide data on forests in 2024, including up to 26 percent of the companies in the S&P 500 that are already CDP reporters. - CDP is now asking for disclosure of information on governance, strategy and risk management for general environmental matters. Previously, companies were asked to report their approach to governance, strategy and risk management on a topic-specific basis. For the 2024 questionnaire, companies will instead be asked to report on their approach to general environmental matters, helping align the CDP questionnaire with existing ESG reporting practices.

- The 2024 CDP questionnaire introduces a double materiality approach for reporting companies, with new questions on nature-related dependencies[1], impacts[2], risks and opportunities (“DIROs”). Measuring nature-related impacts and dependencies can be a technical and time intensive exercise. Companies that have conducted a double materiality assessment aligned with the GRI Standards or to prepare for disclosure under the European Union’s Corporate Sustainability Reporting Directive (“CSRD”) are better positioned for the new CDP process.

- CDP intends for key changes in the new questionnaire to support alignment with new and emerging ESG laws and regulations around the world. The 2024 CDP questionnaire is partially aligned with the European Sustainability Reporting Standards (“ESRS”)[3] and the International Financial Reporting Standards (“IFRS”) S2 Climate-related Disclosures standard. Companies that report their sustainability data to CDP in 2024 should closely review their responses to avoid inconsistencies with upcoming regulatory and voluntary disclosures.

Key Changes to Existing CDP Questions

The consolidated 2024 CDP questionnaire includes line-item changes to over 100 individual questions that were previously included in separate climate change, forests and water security questionnaires. CDP reporters should be attentive to revised questions, which include:

-

The 2024 questionnaire asks for significantly more detail on the financial impacts and costs for sustainability-related matters. Developing or retrofitting existing financial systems to track financial impact metrics and related spending may be a time-consuming undertaking for reporting entities that have not already integrated resources from Finance into their sustainability programs.

Percentage of U.S.-based CDP reporters that have previously reported climate-related financial impact metrics to CDP

31%

Percentage of U.S.-based CDP reporters that have previously reported on sustainability-aligned spending to CDP[4]

9%

- The 2024 questionnaire asks companies how they define “substantive” environmental effects on their organization. This includes new questions on the specific indicators (e.g., capital expenditures or revenues) and quantified thresholds (e.g., an absolute increase of 10%) that companies use to identify substantive environmental risks or opportunities.

- CDP is taking a deeper dive into formal board oversight and requesting details on environmental competencies of senior leadership. For both board- and management-level competencies, CDP is asking about the mechanisms used for achieving and maintaining environmental expertise. The 2024 questionnaire also requests additional detail on how companies establish accountability for environmental performance and how they memorialize governance in documents such as board committee charters.

- CDP is asking for comprehensive disclosure on the use of environmental scenario analysis. Requested details include the specific scenarios used and related risks, and companies are now asked to provide details for each scenario they use to identify and manage environmental risks.

Action Items for Reporting Companies

We recommend that companies gearing up for the 2024 CDP disclosure cycle take the following actions to get ready:

- Start now: The CDP portal is open for reporting companies, with a September 18th reporting deadline for companies that want to receive a CDP score. If not already underway, companies should start on their response to the 2024 CDP questionnaire now, including an assessment of internal and external resources necessary to prepare for the new process.

- Zoom out: While the consolidated CDP questionnaire represents a challenge for reporting companies, the revised structure may align with existing sustainability efforts and disclosures. Consider how you can leverage existing ESG disclosures and other assets to prepare for CDP’s new questions. Additionally, consider how you can leverage CDP’s new disclosure requests to identify relevant workstreams for your ESG program in the future.

- Ensure controls are in place: The volume of environmental disclosure in the 2024 CDP questionnaire increases the risk of inaccurate disclosures. Companies should ensure that sufficient resources are available to review and validate responses to the 2024 CDP questionnaire— and to ensure alignment with upcoming regulatory disclosures.

- Develop your definition of “Substantive” Effects: The 2024 CDP questionnaire asks for detailed information on how a company defines substantive environmental effects— a determination that should not be made by sustainability teams in a silo. Companies should consider developing clear disclosure thresholds, not just for the 2024 CDP questionnaire but also for other reporting requirements including the SEC climate disclosure rules and reporting under the CSRD.

- Integrate Finance: Internal resources from Finance will play an increasingly important role in corporate sustainability programs, and this is also true with respect to the 2024 CDP questionnaire. Finance holds key metrics for the 2024 CDP questionnaire, including data related to sustainability-aligned spending and financial impact metrics. Integrating Finance into the sustainability program can also help organizations connect sustainability with corporate strategy and financial planning, which can unlock new resources.

- Take one step at a time: Companies preparing for the 2024 CDP questionnaire will need to adapt to the new reporting process while balancing limited resources. It is essential for companies to adopt a careful and deliberate approach to expanding their CDP disclosures. Instead of trying to do it all, companies should be practical with the information that they have now and build a playbook to collect information for CDP reporting in future cycles.

[1] CDP defined dependencies as “aspects of nature’s contributions to people that a person or organization relies on to function, including water flow and quality regulation; regulation of hazards like fires and floods; pollination; [and] carbon sequestration.”

[2] CDP defines impacts as “positive or negative contributions of a company or other actor toward the state of nature, including pollution of air, water, or soil; fragmentation or disruption of eco-systems and habitats for nonhuman species; and alteration of ecosystem processes.”

[3] In November 2023, the European Financial Reporting Advisory Group (“EFRAG”) and CDP announced a cooperation to drive market update of the ESRS by integrating relevant metrics in the ESRS into CDP questionnaires. Link.

[4] Based on the percentage of CDP reporters that responded “Yes” to the 2023 CDP question “In your organization’s financial accounting, do you identify spending/revenue that is aligned with your organization’s climate transition? ”