ESG-Related Shareholder Proposals – Takeaways from the First Half of 2022

July.25.2022

ESG-related shareholder proposals featured prominently in the most recent proxy season, with nearly 40% of large-cap public companies facing a shareholder vote on ESG topics in the last six months. We reviewed ESG-related proposals submitted to companies in the Fortune 250 over the first half of 2022 to identify new developments and trends in this area and to anticipate future proposals.

While the proxy season is over for many companies and many other companies are beyond the advance notice period for shareholder proposals, companies should expect to receive shareholder ESG-related proposals, especially concerning climate change, human rights, and diversity. However, companies can prepare and potentially avoid such proposals by increasing their ESG disclosures in proxy statements or reports. The most common type of shareholder proposal identified in our review called for companies to prepare a report on a key ESG topic, most often climate change. By making relevant ESG information publicly available, companies may be able to avoid receiving future shareholder proposals calling for votes that could force increased and unplanned transparency.

Interestingly, there were relatively fewer proposals that called for companies to take prescriptive measures on ESG, such as setting specific greenhouse gas emissions reduction targets. Prescriptive shareholder proposals also received significantly lower levels of support across most types of ESG topics, with the exception of civil rights or racial equity audits. While it is difficult to pinpoint the reasons for this trend, public companies have been increasing transparency into their human capital management consistent with changes in SEC rules. Accordingly, we believe proactively building internal programs to address diversity and disclosing relevant diversity data may help preempt prescriptive shareholder proposals that specifically target diversity-related issues.

Approved ESG-Related Shareholder Resolutions

Across the Fortune 250, we identified 221 ESG-related shareholder proposals received by 98 companies during the first half of 2022. Of the 221 ESG-related shareholder proposals, 21 received a passing vote. Additionally, 17 of the 21 ESG-related shareholder proposals that received a passing vote were recommended against by the board.

Details regarding the 21 passed ESG-related shareholder proposals are included in the table below:

|

Company |

Proposal |

Board Recommendation |

Votes For |

|

Altria Group, Inc. |

Civil Rights Equity Audit |

Against |

62.16% |

|

Apple Inc. |

Report on Civil Rights Audit |

Against |

53.55% |

|

Report on Company Risks through Use of Concealment Clauses |

Against |

50.04% |

|

|

Caterpillar Inc. |

Report on Climate Policy |

For |

95.50% |

|

Chevron Corp |

Report on Reliability of Methane Emission Disclosures |

For |

98.00% |

|

Chubb Limited |

Report on Greenhouse Gas Emissions |

Against |

72.18% |

|

Costco Wholesale Corp |

Adopt GHG Emissions Reduction Targets |

Against |

69.95% |

|

Dollar General Corp |

Report on Political Spending |

Against |

56.99% |

|

Dominion Energy, Inc. |

Report on Risk and Impacts of Natural Gas Use |

No Recommendation |

80.13% |

|

Exxon Mobil Corp |

Financial Statement Assumptions & Climate Change |

Against |

51.00% |

|

International Business Machines Corp |

Public Report on the Use of Concealment Clauses |

Against |

64.70% |

|

Johnson & Johnson |

Third-Party Racial Justice Audit |

Against |

62.64% |

|

Lowe’s Companies, Inc. |

Report on Racial & Gender Pay Gaps |

Against |

58.01% |

|

McDonald’s Corp |

Third Party Audit of Stakeholder Civil Rights |

Against |

55.14% |

|

The Boeing Co |

Report on Net Zero Indicator |

For |

89.09% |

|

The Home Depot, Inc. |

Racial Equity Audit |

Against |

62.77% |

|

Report on Deforestation |

Against |

64.66% |

|

|

The Travelers Companies, Inc. |

Report on Lobbying |

Against |

62.34% |

|

Report on Measuring Underwriting of GHG Emissions |

Against |

55.24% |

|

|

The Walt Disney Co |

Report on Pay Equity |

Against |

59.12% |

|

Waste Management, Inc. |

Civil Rights Audit |

Against |

54.46% |

Number, Source, and Type of Proposals

There was a significantly larger number of ESG-related shareholder proposals submitted in the first half of 2022 relative to all of 2021 across the Fortune 250. A total of 221 resolutions were proposed in the first half of 2022, compared to 128 for all of 2021.

ESG-focused investing funds and shareholder advocacy groups drove the significant increase, with these organizations, including the shareholder advocacy group As You Sow and the impact investor Arjuna Capital, accounting for 51% of ESG-related shareholder proposals submitted in the first half of 2022 to the Fortune 250, compared to just 33% for all of 2021.

- As You Sow submitted 810 ESG-related shareholder proposals across hundreds of public companies,[1] including eight successful climate-related resolutions at ExxonMobil, Phillips, Caterpillar, Boeing, Chubb, Travelers, and Dollar Tree. An additional 93 resolutions were withdrawn after As You Sow reached an agreement with the respective company. As You Sow accounted for just over 7% of all shareholder proposals in the first half of 2022 across the Fortune 250.

- Additionally, part of the increase was due to increased shareholder activism from the National Legal and Policy Center and the National Center for Public Policy Research. Together, these entities submitted over 12% of all ESG-related proposals in the first half of 2022 across the Fortune 250, compared to no submissions in 2021.

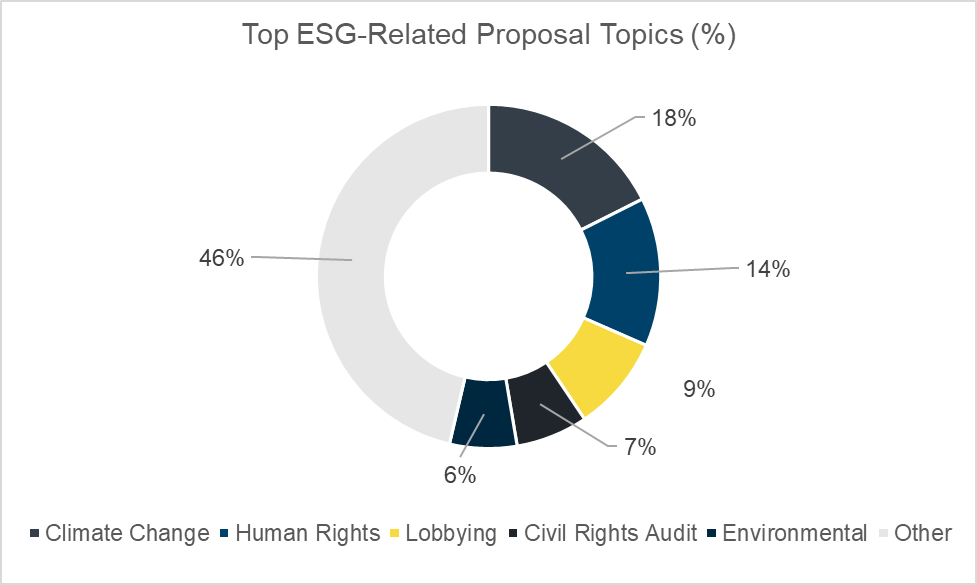

The top five types of ESG-related proposals covered climate change, human rights, lobbying, civil rights, and general environmental topics.

Additionally, certain topics saw a significant increase in prevalence between 2021 and the first half of 2022. In percentage terms, the ESG-related topics which saw the greatest increase in the number of proposals included employee rights, privacy and information,[2] general environmental topics, human rights, and climate change.

Emerging Investor Consensus and Declining Support

While the total number of ESG-related proposals and the total number of approved ESG-related resolutions has increased significantly from 2021 to 2022, the overall level of support for ESG-related proposals decreased. The pass rate in the first half of 2022 was 9.5%, significantly less than the 17% pass rate for ESG-related proposals for all of 2021.

This is in part due to some of the major asset managers cooling off their support for prescriptive climate- and environmental-related proposals. For instance, in May 2022 BlackRock issued an update on their approach to climate-related shareholder proposals, stating that “many of the climate-related shareholder proposals coming to a vote in 2022 are more prescriptive or constraining on companies and may not promote long-term shareholder value.”[3]

Additionally, we identified an emerging investor consensus in the types of climate-related proposals that received a passing vote. There are three major types of climate-related proposals:

- Requests for increased climate-related reporting,

- Requests for GHG emissions reduction targets, and

- Requests for companies in the financial sector to set policies ending or restricting their investment in fossil fuels.

Proposals calling for increased climate-related reporting had the most success, with a passing rate of 28.57% in the first half of 2022, while other proposals did not fare as well as detailed in the table below.

|

Type of Proposal |

Number of Proposals |

Pass Rate to Date (%) |

|

Climate Reporting |

21 |

28.57% |

|

Emissions Targets |

8 |

12.50% |

|

Investment Policies |

8 |

0.00% |

The higher passage rate for climate-related reporting proposals may indicate that investors value receiving additional climate-related information and are less interested in holding companies to specific targets or climate-related goals. As such, companies may be able to avoid receiving shareholder proposals related to climate and other ESG topics and improve investor relations by proactively building programs and preparing disclosures that meet current market standards for transparency and insight into ESG initiatives.

[1] https://www.asyousow.org/resolutions-tracker

[2] Including proposals specifically targeting social media companies related to data privacy, the spread of misinformation on social media platforms, and board and committee oversight of privacy and information efforts.

[3] BlackRock “2022 climate-related shareholder proposals more prescriptive than 2021” May 2022. Web.

Link: https://www.blackrock.com/corporate/literature/publication/commentary-bis-approach-shareholder-proposals.pdf