VINCI Airports Secures €120M Sustainability-Linked Financing for Cape Verde Airports

2 minute read | January.20.2026

The infrastructure investment gap and the cost of achieving energy innovation goals exceed $6 trillion in the U.S. There’s never been greater need or greater opportunities to address it. Whether you’re a private or public owner of infrastructure or energy assets – and it’s time to upgrade your campus, expand public roads, water, wastewater, aviation, port assets, or implement energy, digital or resiliency improvements – alternative or innovative delivery models present a path forward.

We guide our clients through the entire lifecycle of an infrastructure or energy project and deliver innovative solutions in an evolving landscape.

Whether you’re thinking about delivering a current or future project, Orrick’s combined team of public finance and energy & infrastructure lawyers provides early-stage advisory services concurrently – so you’re optimizing the project delivery and financing solution at the same time.

Our team works on every alternative project delivery method in the market, helping our clients build and deploy solutions including:

Our Chambers Band 1 recognition in public finance, P3 and energy and record as No. 1 municipal bond counsel for more than 25 years (Bond Buyer) reflects our commitment to delivering high-quality legal solutions.

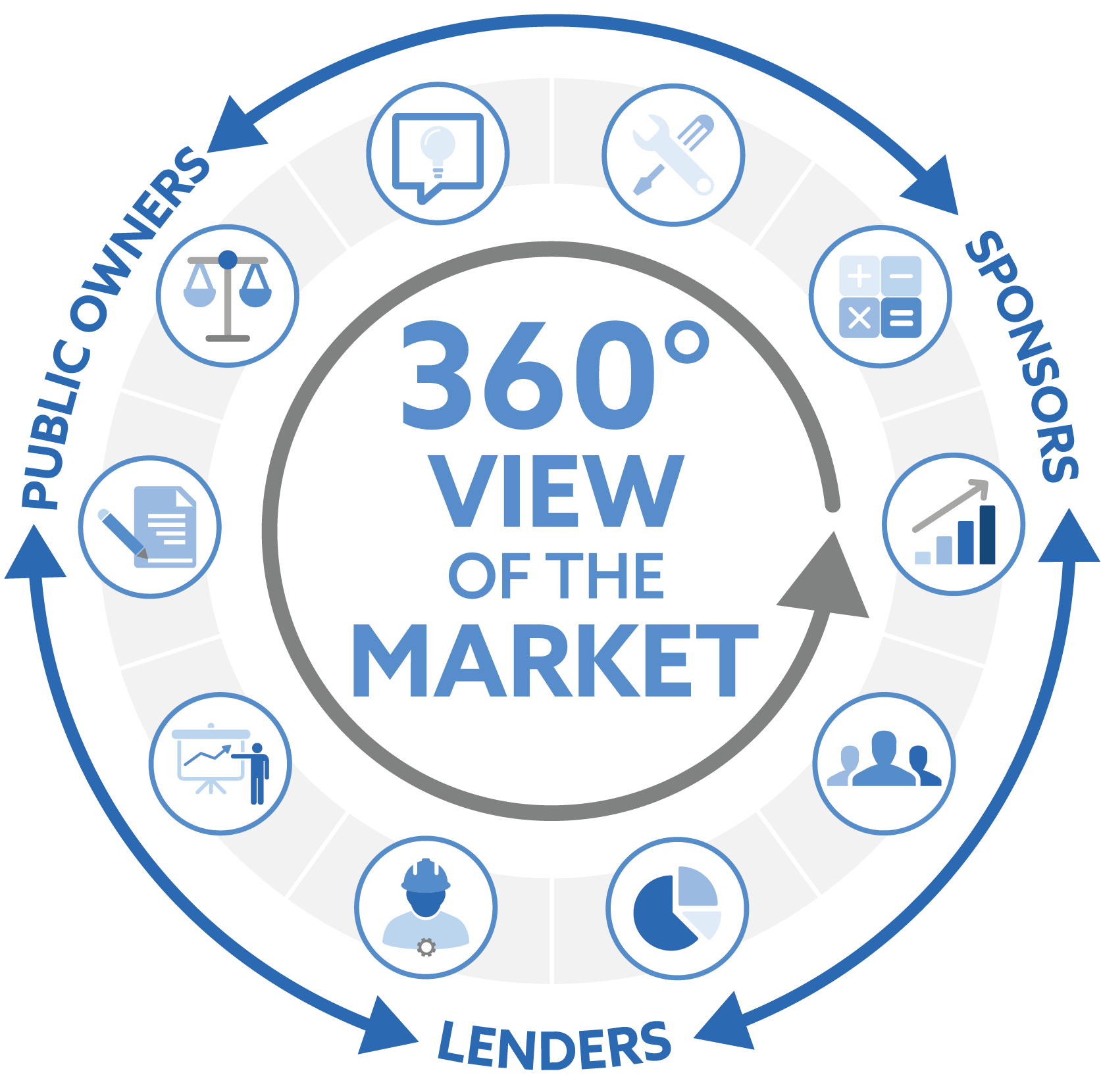

Our coordinated approach gives us a 360-degree view – for owners, developers, lenders, and investors. Our sector experience is just as expansive – spanning the full spectrum of core and non-core infrastructure assets, including:

2 minute read | January.20.2026

2 minute read | December.22.2025

2 minute read | February.11.2026

February.09.2026 - February.11.2026

September.29.2025 - September.30.2025

1 minute read | January.20.2026

.png)