California’s Climate Law Pushes for Financial Impact Disclosures

6 minute read | May.30.2025

This article was originally published on Bloomberg Law.

California’s SB 219 is the first state law requiring broad-based reporting of material climate-related financial risk by US companies. With the initial reporting deadline set for Jan. 1, 2026, companies are actively identifying and assessing their climate-related risks to address compliance.

A rigorous effort to comply with SB 219 will drive disclosure of significant climate-related costs not previously reported to the market, helping companies, investors, and other stakeholders more effectively identify and manage climate-related risks.

Companies must navigate these changes, including reputational risks where customers see companies as contributing to climate change, and market risks where changes in the supply and demand for commodities, products and services may be significantly impacted by the changing climate.

We estimate that public companies subject to SB 219 face more than $1.2 trillion in collective financial risk. [1] The total financial impact to the US private sector is likely to be much higher, considering the risk private companies face.[2] Only one-third of this exposure was reported in 2024 by public companies likely subject to SB 219 through CDP, the world’s largest environmental disclosure system, and many US companies face significant amounts of undiscovered climate-related risk now potentially subject to disclosure under SB 219.

SB 219 applies to public and private US companies that do business in California and requires:

- Disclosure of material climate-related financial risk faced by companies with revenues over $500 million.

- Disclosure of greenhouse gas emissions for companies with more than $1 billion in revenue.

- Compliance from public and private companies to avoid regulatory penalties, reputational risk, and investor scrutiny.

Companies face climate-related financial risk from multiple directions. The physical impacts of climate change can hinder business continuity and increase operational costs by directly disrupting operations or destabilizing supply chains due to more frequent and severe hurricanes, wildfires, and other extreme weather events. In 2024 alone, extreme weather and climate disasters in the US caused more than $184 billion in damages.[3] Climate change can also include longer-term shifts in climate patterns such as sea level rise or rising mean temperatures with potentially significant impacts on the performance or valuation of assets over time.

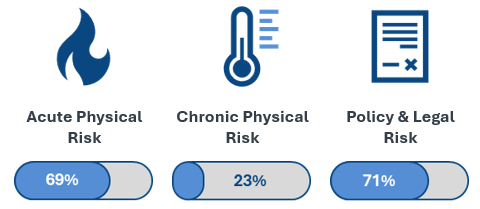

Prevalence of Substantive Climate-related Risks

(Percentage of companies which identified a substantive climate-related risk, for each type of risk, based on public responses to the 2024 CDP Questionnaire for 181 U.S.-based companies identified by Orrick as having robust climate risk assessment processes)

Any single physical or transition risk driven by climate change may not have a meaningful impact on a company’s financial performance or position. But together, they can be substantial. Where large US public companies have conducted robust climate risk assessments the cumulative financial impact of both physical and transition risks over time are greater than 5.3% of current revenues, on average. For certain sectors, including energy, utilities, and transportation, the financial impacts are much higher.

Compliance with SB 219 will likely push more companies to identify financial impacts not previously assessed. Most reporting on climate change by US companies to date was done on a voluntary basis, and there are diverse approaches when it comes to identifying and assessing where and how climate change can impact a business.

Companies should consider adopting best practices for climate risk assessments, including:

- Evaluating internal readiness and benchmarking against industry-wide practices.

- Strengthening data governance to support consistent and auditable disclosures.

- Aligning with international climate-related financial disclosure frameworks (TCFD or IFRS S2).

- Enhancing internal controls and risk management around climate-related financial reporting.

- Continuously monitoring strategies for adaptation and mitigation to these risks.

Climate risk assessments should cover direct operations, the value chain and be integrated into the broader enterprise risk management framework. Robust climate risk assessments should apply forward-looking scenario analysis to explore different potential climate outcomes and leverage qualitative and quantitative methods to identify and measure risks. Climate risk assessments should measure the financial implications of climate risks by assessing the impact of climate change on areas including revenues, costs, capital planning, and asset valuations.

Prevalence of Climate Risk Assessment Processes

(based on public responses to the 2024 CDP Questionnaire for U.S.-based companies with more than $500 million in revenue)

Less than a quarter of US public companies subject to the climate risk disclosure requirements of SB 219 have disclosed a comprehensive climate risk assessment that includes each of the above elements. As more companies conduct these robust assessments to prepare for compliance, we expect to see growing disclosure of financial impacts from climate change.

Robust climate risk assessments will also give companies, investors and other stakeholders better visibility over the effect of climate change on a company’s financial position – including impacts on access to and the cost of capital, changes in insurance premiums, and shifts in the valuation of assets and liabilities.

Proactive companies that act now will be better positioned to ensure compliance, build investor trust, and enhance long-term resilience.

[1] Our estimate of a $1.2 trillion financial impact from climate-related risks is informed by CDP data provided by 817 U.S.-based companies with revenues over $500 million. Using CDP data, we identified a subset of 181 companies that had robust climate risk assessment processes, including detailed analysis in the value chain, analysis of financial impacts, and the use of technical scenario analysis to understand the impacts of climate change in the future. Companies which had a comprehensive climate risk assessment process reported a maximum financial impact from climate change over the short-, medium- and long-term representing 5.3% of their current revenue, on average. We used this figure to model the total potential financial impact for public companies in the Russell 3000 that meet the $500 million revenue threshold under SB 219, based on revenue reported for the most recent fiscal year. Figures provided by Orrick are based on public-only disclosures through CDP, and do not include non-public data provided companies to CDP.

[2] Analysis published in September 2023 by the California Senate Rules Committee regarding SB 261, a predecessor bill to SB 219, estimated that among the over 10,000 companies who do business in California and exceed the $500 million revenue threshold, only 20% of them are publicly traded.

See https://leginfo.legislature.ca.gov/faces/billAnalysisClient.xhtml?bill_id=202320240SB261

Supplemental research published by Ceres found 2,675 companies with revenues over $500 million which are likely covered by SB 261, and further found that 73% of them are public companies.

[3] Based on data provided by the NOAA National Centers for Environmental Information

https://www.ncei.noaa.gov/access/billions/