2024 Proxy Season Considerations: Officer Exculpation for Delaware Corporations

5 minute read | January.08.2024

Note: This insight, updated on January 19, 2024, now reflects the outcome of a Delaware Supreme Court case that was pending at the time of the original publication. Refer to footnote number 1 for details.

A change to DGCL Section 102(b)(7) that took effect last year permits Delaware corporations to eliminate or limit the personal liability of corporate officers for monetary damages to stockholders for breaches of their fiduciary duty of care. Given significant stockholder support for a handful of officer-exculpation proposals this year, Delaware corporations that have weighed the issue should consider asking stockholders to act during the 2024 proxy season.

Officers would still be subject to liability for breaches of their duty of care for claims brought by or in the right of the corporation, including derivative claims. Like directors, officers also remain subject to liability for breaches of the duty of loyalty, actions not in good faith, intentional misconduct, knowing violations of the law and transactions resulting in improper personal benefits for executive officers.

Addressing Unequal Treatment of Directors and Officers

Legislators amended the Delaware General Corporation Law to address rising litigation and insurance costs – and the unequal treatment of directors and officers, both of whom owe similar fiduciary duties to their corporations and stockholders.

Prior to the amendment, only directors could be protected from duty of care liability by a corporation’s Section 102(b)(7) exculpation provision.

This disparate treatment incentivized the plaintiffs’ bar to target officers in stockholder class-action litigation related to mergers and other strategic transactions. Officers faced greater litigation risk than directors for the same conduct. Breach of fiduciary claims against directors could be dismissed on the basis of the corporation’s Section 102(b)(7) provision, but officers could face substantively identical claims, increasing defense costs exponentially (and often resulting in substantial monetary settlements).

The amendment of Section 102(b)(7) allows corporations to place officers on equal footing with directors with respect to direct claims asserted by stockholders (as opposed to derivative claims).

An Agenda Item for the 2024 Proxy Season?

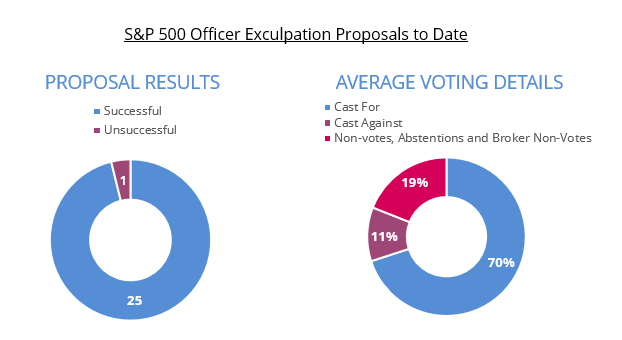

With uncertainty over stockholder and proxy advisor support for charter amendments to implement such changes, many Delaware public corporations have deferred seeking stockholder approval to amend their charters. However, the significant stockholder support for these proposals during the 2023 proxy season, particularly from the S&P 500 corporations that proceeded with an officer-exculpation proposal, should encourage others to consider pursuing a charter amendment for officer exculpation at their 2024 annual meeting of stockholders.

As shown above, only one of the S&P 500 corporation proposals failed to receive the necessary support to amend the charter. However, that corporation required a two-thirds supermajority to amend its charter and came within just 3% of adopting the amendment, suggesting an overall support for that amendment on a votes-cast basis.

Also, after the amendments to Section 102(b)(7) took effect, close to 60% of Delaware corporations revising their certificates of incorporation during an IPO have incorporated officer exculpation provisions.

How Delaware Corporations Can Shield Officers

To benefit from the changes to Section 102(b)(7), Delaware corporations must amend their certificate of incorporation.

First, the board should review the rationale for such an amendment after seeking input from counsel and potentially from large stockholders. In their proxy disclosures, corporations often cited the below rationales:

- Fairness for officers.

- The ability to attract and retain qualified officers.

- Possible reduction in litigation costs, distractions and D&O insurance premiums.

- Adapting to industry trends.

In some cases, corporations also noted to investors that officers would remain personally liable to the corporation for breach of fiduciary duty of care claims, including derivative claims.

Next, the stockholders must vote on the proposal.[1] In preparing for the vote, corporations are reminded:

- A charter amendment proposal is not considered “routine,” and therefore, requires the filing of a preliminary proxy statement at least 10 days before filing the definitive proxy statement.

- To consider and review the policy guidelines of the major proxy advisory firms.[2]

- As shown above, a supermajority requirement and/or a broad stockholder base can pose significant hurdles to stockholder approval and should be considered early in the planning process.

Corporations should work with legal counsel and, if appropriate, a proxy solicitor to develop a strategy to obtain the required support.

Officers Who May Be Exculpated

Officers covered by the amendments to Section 102(b)(7) include:

- The corporation’s president, chief executive officer, chief operating officer, chief financial officer, chief legal officer, controller, treasurer or chief accounting officer.

- Any officer identified in SEC filings as one of the most highly compensated executive officers at the time of the alleged wrongdoing.

- Any officer who has agreed in writing to be identified as an officer for purposes of accepting service of process.

Want to know more? Contact one of the authors or your regular Orrick contact.

[1] The Delaware Supreme Court has held that a class vote is not required to approve an officer exculpation charter amendment where a Delaware corporation has a multi-class capital structure.

[2] For example, ISS and Glass Lewis have said they will make voting recommendations on officer exculpation charter amendment proposals on a “case-by-case” basis. Glass Lewis has specifically noted, “We will generally recommend voting against such proposals eliminating monetary liability for breaches of the duty of care for certain corporate officers, unless compelling rationale for the adoption is provided by the board, and the provisions are reasonable.”