Tech Capital Markets Outlook: A Conversation with Evercore

3 minute read | March.12.2024

The 2024 election cycle and continuing geopolitical risks are likely to bring even greater volatility to the capital markets this year – there’s consensus on that.

Due to the election cycle, tech companies looking to go public are targeting a shorter IPO window, with an overwhelming preference to get out before July, Evercore’s John Scuorzo and Zaheed Kajani tell Orrick’s Jamie Evans. Two or three successful tech IPOs may spur a second wave of fast followers, though overall, the hopeful expectation is that tech IPO activity in 2024 will reach about half of the historical average of about 40 IPOs raising $20 billion.

Drawing on insights from last year’s few tech IPOs, cornerstone investors will likely play a more moderate role in offerings (10-15% of total deal size) and there will be a return to deal sizes of about 10-15% of market cap to attract large public investors who value liquidity long term. The proliferation of novel structures such as SPACs may pause, but Kajani and Scuorzo expect the traditional IPO playbook to continue to evolve. For instance, there continues to be interest in innovating to provide more liquidity options to investors, and sooner.

Regulation will also play into the way in which tech companies access the capital markets, Evans says. There is tremendous focus on emerging technologies like AI and significant and high-profile enterprise risks like cybersecurity, which is likely to increase scrutiny on disclosure and transaction diligence. Furthermore, the SEC’s recent rule-making efforts related to SPACs is consistent with the more active regulatory posture seen during the Biden administration, and there will be knock-on effects that impact other, more traditional parts of the capital markets.

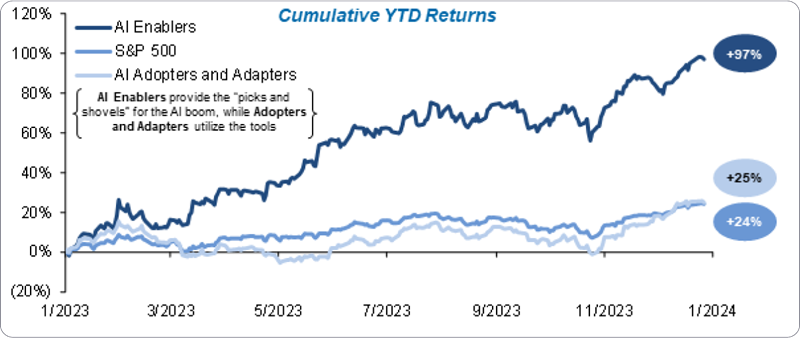

Public AI “Enablers” Outperformed in 2023

Source: Bloomberg, Evercore ISI

AI Enablers: Equal Weighted Returns of AMZN, GOOGL, INTC, LRXC, META, MSFT, NVDA

AI Adopters and Adapters: Equal Weighted Returns of ADBE, AES, ARE, BKNG, BXP, CDAY, CLH, DUOL, DPZ, EMR, ETN, ETSY, EXPE, GDDY, JPM, PINS, PSTG, TMUS, VEEV, WDC, ZS

Companies enabling the deployment of AI – such as semiconductor and software companies – are seeing returns today and will be the first to experience the success or failure of those investments, Scuorzo says. 2024 will be the year of adopters and adapters as management and boards turn to deploying genAI and other hyperproductivity tools to grow their business, streamline costs and future-proof against competitors.

This conversation was featured in The Download. To learn more or subscribe to our market update, see here.